BUY VIETNAM THIS MONTH

Sa Giang, seafood chips

NiNa Vietnam, agriculture products

THACO, mechanical manufacturing

Vietnam Indochina, agricultural products

MEE, pepper

Lam San Farmers Cooperative, agricultural products

ChiliCa, hot chili sauce

Trung Thanh, food

Binh Minh, rice straw

Lotus Rice, rice, pepper, coffee

Bamboo, food

Sunrise, fruit and vegetable

HEADLINES

Vietnam’s High Growth Import and Export Industries

- Vietnam’s economy is expected to grow by 6.5 percent in 2021 subject to how the country can control the latest COVID-19 outbreak

- The US remains Vietnam’s biggest export market, followed by China and the EU.

- We look at Vietnam’s sustainable trade industries suited for high-growth import and export.

The US was Vietnam’s largest export market in the first four months of the year with a value of US$30.3 billion, up 50 percent year-on-year with China coming in at second, followed by the EU according to Vietnam’s General Statistics Office (GSO).

We examine the five most sustainable trade industries, suited for high-growth export and import.

Electronics

Vietnam has emerged as a major electronics exporter, with electrical and electronic goods overtaking textiles, coffee, and rice to become the top export item.

This has been attributed to increased imports from several Asian countries including, Japan, South Korea, and China. In 2019, electronics accounted for 36 percent of the country’s exports, up 1.15 percent in 2018. To move domestic manufacturing up the value chain, many companies in the country are investing in machinery and technology to support more exports.

Currently, 95 percent of electronic exports are dominated by foreign-invested businesses, particularly those that produce smartphones and CCTVs. Vietnam relies heavily on imported machinery and equipment from China, followed by South Korea and Japan, in this industry.

Businesses that need to import machinery to produce electronics should note that the authorities passed Decree No 18/2019/QD/TTg to ban the import of outdated, poor quality, and unsafe equipment.

Footwear

The footwear industry has benefited from several favorable factors throughout its growth in the country. The EU-Vietnam free trade agreement (EVFTA) is expected to significantly help the sector. Top footwear exports were to China, the EU, and the US. Major US footwear companies such as Nike and Sketchers have already shifted production to Vietnam. The Producers Guild of America (PGA) is also working on a tax bill that will cut tariffs on several lines of imports that include footwear and textile produced from Vietnam.

Vietnam is able to supply leather materials and accessories for the footwear market. It’s forecast that Vietnam will be able to supply 60 percent of the leather materials required domestically by 2030, compared to the 45 percent manufacturers sourced locally in 2018. Footwear and leather exports hit nearly US$16.5 billion in 2020, down 10 percent due to the pandemic.

Due to the disruption caused by the pandemic, Vietnam Leather, Footwear and Handbag Association (LEFASO) noted that local firms should take advantage of the opportunities such as the free trade agreements and US-China tensions to boost productivity and exports. The industry still needs to address increasing labor costs, and the Industry 4.0 question mark, but many analysts expect the industry to remain competitive for the next two decades.

Garment and textiles

Vietnam has approximately 6,000 garment and textile manufacturing companies employing 2.5 million people, and its top export destinations are leading consumer markets – the US, Europe, Japan, and South Korea.

The industry’s growth is also being fueled by increased domestic consumption, fueled by a young demographic, and increasing urbanization. Retail sales are growing at a rate of 20 percent annually and are forecast to expand, thanks to several free trade agreements.

Germany-based Amann Group and US-based Kraig Biocraft Laboratories are among the companies that are poised to scale up manufacturing production in Vietnam. Due to the US-China trade war, the help of Vietnam’s FTAs, analysts believe the industry will maintain high growth potential, with a forecast export turnover of US$200 billion until 2035.

Furniture, prefabricated buildings

Furniture, lightings, and prefabricated buildings feature high on Vietnam’s export list. The sector accounted for 4.4 percent of Vietnam’s exports in 2020. The effect of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and EVFTA is further expected to propel Vietnam as the second-largest interior furniture exporter after China in the next seven to eight years with new markets in Canada and Mexico, apart from traditional markets like the US, EU, China, and South Korea. The industry is expected to grow by 16 percent year on year. Even with this growth, the furniture industry remains small and has immense potential to become a major supplier and exporter.

The same can be said about prefabricated buildings, which are building structures that are manufactured offsite and transported for onsite assembly. Such types of buildings are gaining in popularity not only in the commercial sector but also in the residential living space. The government wants the building materials sector to achieve a higher level of automation by 2030.

Oil

As the country grows, its energy needs grow as well. Between 2012 and 2017, Vietnam exported more oil than it imported, with average exports at about 8.3 million tons a year and imports at 750,000 tons a year. This trend reversed in 2018, with imports at 5.17 million tons and exports at 3.96 million tons, down 41.8 percent compared to the previous year.

This trend is likely to continue, particularly due to the demand for jet fuel. With more tourists, the aviation industry is growing significantly, leading to higher fuel consumption. While Vietnam started two refineries in 2018, they mainly produce gasoline and diesel; demand for jet fuel will continue to remain from existing suppliers like Singapore, Thailand, and China. While it’s true that oil demand has been significantly affected by border closures and covid-related restrictions, it will change once the pandemic is brought under control.

Vietnam’s oil industry remains heavily state-controlled. To address falling oil output and meet demand, Vietnam will need to explore untapped deep waters as compared to its present shallow southern basins. Long-term gas development will largely depend on government commitment to monetize reserves and taking a hit on prices. Vietnam is also a big oil importer due to the lack of its refining capacity.

With domestic consumption growing faster than China due to a surging economy, petroleum product demand is expected to rise 660,000 barrels of oil per day in 2030. While Vietnam has the resources to meet future needs it will need to attract private investment with the right regulations and policies to meet growing energy demand.

FROM THE BEGINNING OF THIS YEAR

Sweden exports to Vietnam

| Products | 7M2020 | 7M2021 | Change |

|---|---|---|---|

| All products (USD) | 210,350,277 | 200,841,261 | -4.52% |

| Other machinery, equipment, tools and spare parts | 56,622,390 | 71,844,905 | 26.88% |

| Pharmaceutical products | 41,368,685 | 37,979,849 | -8.19% |

| Paper products | 22,702,798 | 19,680,779 | -13.31% |

| Chemical products | 7,600,197 | 12,425,889 | 63.49% |

| Iron or steel | 7,701,240 | 8,695,253 | 12.91% |

| Wood and articles of wood | 4,006,054 | 7,568,590 | 88.93% |

| Plastic products | 1,958,786 | 4,729,390 | 141.44% |

| Articles of iron or steel | 2,990,859 | 4,108,677 | 37.37% |

| Plastic materials | 1,459,994 | 2,373,664 | 62.58% |

| Computers. electrical products. part thereof | 2,278,463 | 1,618,202 | -28.98% |

| Other petroleum products | 589,214 | 854,948 | 45.10% |

| Telephone sets, parts thereof | 53,837 | 42,681 | -20.72% |

| Other goods | 61,017,760 | 28,918,434 | -52.61% |

Sweden imports from Vietnam

| Products | 7M2020 | 7M2021 | Change |

|---|---|---|---|

| All products (USD) | 670,385,094 | 620,394,014 | -7.46% |

| Telephone sets, parts thereof | 357,595,854 | 274,946,339 | -23.11% |

| Footwears, parts of such articles | 44,244,447 | 53,278,790 | 20.42% |

| Machinery, mechanical appliances, equipment, parts thereof | 42,752,175 | 34,745,473 | -18.73% |

| Textiles and garments | 39,513,537 | 46,510,555 | 17.71% |

| Machinery, mechanical appliances, equipment, parts thereof | 27,199,924 | 33,760,135 | 24.12% |

| Articles of iron or steel | 26,214,549 | 22,951,561 | -12.45% |

| Wood and articles of wood | 16,997,980 | 19,255,429 | 13.28% |

| Bags, purses, suitcases, hats, umbrellas | 15,630,325 | 17,376,246 | 11.17% |

| Plastic products | 11,404,091 | 10,908,175 | -4.35% |

| Fish and crustaceans, molluscs and other aquatic invertebrates | 6,935,444 | 10,411,203 | 50.12% |

| Toys, sports equipment and parts | 5,669,060 | 6,047,165 | 6.67% |

| Products of rattan, bamboo, sedge and carpet | 5,605,524 | 7,455,158 | 33.00% |

| Materials for textiles and garments, and footwares | 3,929,304 | 7,526,388 | 91.55% |

| Ceramic products | 1,385,784 | 2,317,981 | 67.27% |

| Other metals and products | 717,223 | 1,413,330 | 97.06% |

| Rubber | 491,324 | 420,109 | -14.49% |

| Other goods | 64,098,549 | 71,069,977 | 10.88% |

Denmark exports to Vietnam

| Products | 7M2020 | 7M2021 | Change |

|---|---|---|---|

| All products (USD) | 110,085,082 | 143,116,735 | 30.01% |

| Machinery, equipment. tools and spare parts | 28,536,810 | 34,431,590 | 20.66% |

| Chemical products | 16,870,787 | 17,721,835 | 5.04% |

| Pharmaceutical products | 15,329,180 | 16,049,507 | 4.70% |

| Fish and crustaceans. molluscs and other aquatic invertebrates | 12,634,764 | 12,108,397 | -4.17% |

| Materials for textiles and garments, and footwares | 420,991 | 7,663,638 | 1720.38% |

| Articles of iron or steel | 3,157,513 | 4,839,626 | 53.27% |

| Plastic products | 4,039,070 | 4,418,539 | 9.39% |

| Computers, electrical products, part thereof | 3,176,039 | 2,989,505 | -5.87% |

| Electric wires and cables | 1,246,226 | 1,823,593 | 46.33% |

| Milk and dairy products | 982,433 | 1,336,680 | 36.06% |

| Iron or steel | 34,975 | 61,514 | 75.88% |

| Other goods | 23,656,294 | 39,672,311 | 67.70% |

Denmark imports from Vietnam

| Products | 7M2020 | 7M2021 | Change |

|---|---|---|---|

| All products (USD) | 171,755,089 | 215,495,165 | 25.47% |

| Fish and crustaceans, molluscs and other aquatic invertebrates | 24,516,971 | 30,412,278 | 24.05% |

| Textiles and garments | 36,803,187 | 29,711,299 | -19.27% |

| Wood and articles of wood | 16,175,233 | 29,413,172 | 81.84% |

| Furniture products from materials other than wood | 15,897,124 | 19,945,295 | 25.46% |

| Other machinery, equipment, tools and spare parts | 13,533,800 | 13,850,684 | 2.34% |

| Plastic products | 8,784,981 | 13,625,454 | 55.10% |

| Articles of iron or steel | 6,775,970 | 9,000,540 | 32.83% |

| Electric wires and cables | 2,590,708 | 8,622,270 | 232.82% |

| Footwears, parts of such articles | 6,237,393 | 7,326,491 | 17.46% |

| Products of rattan, bamboo, sedge and carpet | 3,207,911 | 5,466,970 | 70.42% |

| Transport vehicles and spare parts | 2,812,899 | 5,320,179 | 89.14% |

| Toys, sports equipment and parts | 4,547,616 | 4,908,674 | 7.94% |

| Bags, purses, suitcases, hats, umbrellas | 4,123,117 | 4,638,659 | 12.50% |

| Ceramic products | 3,029,491 | 4,574,828 | 51.01% |

| Coffee | 1,046,554 | 931,312 | -11.01% |

| Other goods | 21,672,134 | 27,747,060 | 28.03% |

Norway exports to Vietnam

| Products | 7M2020 | 7M2021 | Change |

|---|---|---|---|

| All products (USD) | 188,101,308 | 207,667,556 | 10.40% |

| Fish and crustaceans. molluscs and other aquatic invertebrates | 117,675,633 | 140,482,448 | 19.38% |

| Other machinery, equipment. tools and spare parts | 24,357,311 | 25,095,404 | 3.03% |

| Fertilizers | 7,056,237 | 5,881,187 | -16.65% |

| Chemical products | 1,561,629 | 2,885,953 | 84.80% |

| Articles of iron or steel | 4,271,550 | 1,699,207 | -60.22% |

| Other goods | 33,178,948 | 31,623,357 | -4.69% |

Norway imports from Vietnam

| Products | 7M2020 | 7M2021 | Change |

|---|---|---|---|

| All products (USD) | 72,960,028 | 80,511,508 | 10.35% |

| Footwears, parts of such articles | 12,093,435 | 15,402,053 | 27.36% |

| Textiles and garments | 9,715,520 | 10,411,918 | 7.17% |

| Fish and crustaceans. molluscs and other aquatic invertebrates | 4,723,703 | 5,130,913 | 8.62% |

| Articles of iron or steel | 11,311,509 | 4,343,916 | -61.60% |

| Other machinery, equipment, tools and spare parts | 1,459,888 | 4,222,156 | 189.21% |

| Cashew nuts | 4,037,524 | 3,276,217 | -18.86% |

| Transport vehicles and spare parts | 1,378,985 | 3,248,873 | 135.60% |

| Furniture products from materials other than wood | 3,621,072 | 2,878,147 | -20.52% |

| Plastic products | 1,753,408 | 2,711,276 | 54.63% |

| Cameras, camcorders and components | 1,465,057 | 2,382,617 | 62.63% |

| Wood and articles of wood | 1,238,991 | 1,956,036 | 57.87% |

| Fruits and vegetables | 1,446,859 | 1,833,930 | 26.75% |

| Bags, purses, suitcases, hats, umbrellas | 1,998,738 | 1,823,185 | -8.78% |

| Other goods | 16,715,339 | 20,890,271 | 24.98% |

OTHER NEWS

Vietnamese agricultural exports shine despite pandemic

The agricultural industry has promoted trade successfully despite difficulties caused by the COVID-19 pandemic, contributing to expanding export markets and helping the country gain an impressive trade surplus of US$3.9 billion in the first seven months.

Among trade deals made by the agriculture industry in the period, the most notable was Việt Nam’s lychee exports to Japan. With efforts in negotiation and commitments to comply with Japan’s regulations, Japan authorised Việt Nam to supervise and approve Vietnamese quarantine treatment establishments.

According to Hoàng Trung, director of the ministry’s Plant Protection Department, the department had to continuously work online with Japanese authorities, even implementing online inspection, which created favourable conditions for enterprises to successfully export lychees in 2021.

Ngô Thị Thu Hồng, director of Ameii Vietnam Joint Stock Company, said when Việt Nam was allowed to monitor quarantine treatment establishments, the department’s quarantine staff came to work with the establishments, which helped the lychee exports to be much more favourable than last year.

The department also negotiated with Malaysia on pesticide residues to restore chili exports. The department also broadly solved problems related to the export of fresh fruits and promoted the opening of Việt Nam’s agricultural products market to China, especially for lychees and sweet potatoes.

The ministry’s Department of Animal Health (DAH) also supported more factories to export milk and dairy products, feathers, fishmeal and fish oil to China. It has also completed procedures on exporting processed chicken products to Russia and has so far gained approval from the country.

In addition, the DAH has also exchanged and negotiated with countries such as the United States, China and Russia to open the market for animal products.

According to Nguyễn Quốc Toản, director of the Department of Agricultural Product Processing and Market Development, relevant agencies have negotiated to open more export markets and remove technical barriers to promote the export of agricultural, forestry and seafood produce.

The agencies have also coordinated and exchanged with Vietnamese embassies and trade offices in other countries to have timely analysts and forecasts on agricultural product consumption in key export markets such as Japan, South Korea, the US, the EU and China during and after the pandemic.

Agencies have focused on solving problems on food safety barriers to ease agricultural exports. In the first half, they successfully organised online inspections, which helped 13 enterprises export catfish to the US besides adding 18 and 13 seafood processing establishments for export to Russia and South Korea respectively.

According to Toản, the industry will continue to negotiate to remove importing countries’ trade and technical barriers imposed on Vietnamese agricultural produce.

It will also expand the agricultural product market to economies with complementary product structures with Việt Nam, such as Japan, South Korea, India, the European Union or the Middle East, as well as introducing suitable products in potential markets such as Russia, the Middle East, Africa and ASEAN. — VNS

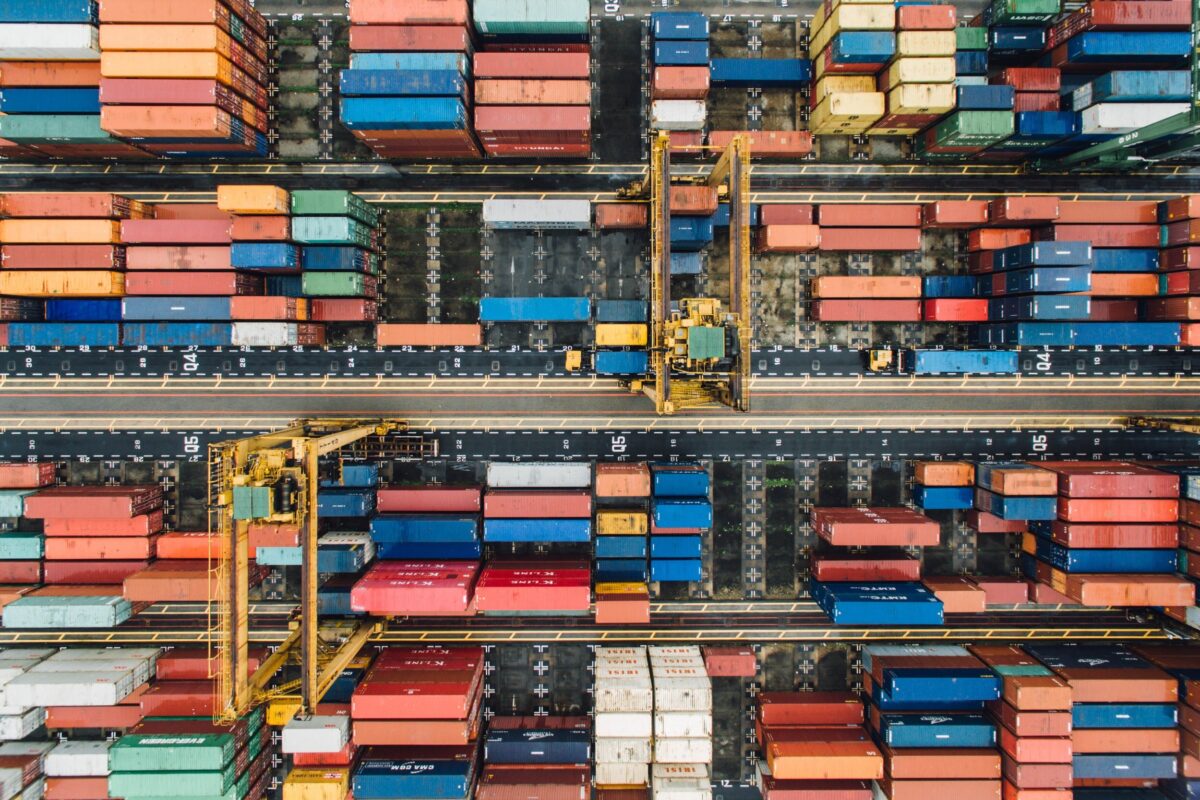

Long An seeks investment in proposed logistics hub

The Long An Province Department of Planning and Investment is soliciting investment to develop a 50ha logistics hub to meet demand from local producers and transporters.

The hub is expected to become a central distribution network for goods, facilitating the province’s socio-economic development.

It is also expected to foster domestic and international trade, and attract investment into the province.

It will come up in Bến Lức, a key district with a great deal of investment in transportation infrastructure and urban development.

The district is also an investor attraction since it is connected with many key roads such as National Highway No. 1 and the Bến Lức – Long Thành Highway.

The project is part of the province’s target of setting up a logistics hub for the Mekong Delta.

Long An plays a key logistics role in the delta, with its coastal location allowing it to transport goods from other provinces.

It is working on setting up six logistics hubs, three in Bến Lức alone.

Two of them are already in operation.

The province has worked to speed up implementation of major transport projects to complete a transport infrastructure system connecting industrial clusters and parks with Long An international port. – VNS

Vietnamese coffee industry to go global

Though COVID-19 has brought challenges to the coffee industry, businesses can nevertheless seek to adapt by exploring innovative and value-added ideas for Vietnamese coffee.

Coffee experts gathered at the RMIT University’s International Business Forum 2021 last week to share how to promote the local commodity to the world.

According to the experts, Việt Nam has consistently ranked among the world’s largest coffee producers and exporters in recent years. Even before COVID-19 and later throughout the crisis, many Vietnamese coffee businesses have made efforts to diversify their export markets, improve quality, leverage the potential of specialty coffee, and expand online marketing and distribution channels.

RMIT International Business Senior Lecturer, Abel Alonso, said: “Responding to the current crisis through value-adding efforts and activities is crucial for Viet Nam’s coffee industry. Besides the established coffee house culture, many hospitality and tourism activities are making coffee their central product, especially in the post-COVID era.”

“Stakeholders in this industry should understand that future development requires increased focus on value-adding activities and raising awareness of Viet Nam’s specialty coffee, as success stories from other countries like Peru demonstrate,” he said.

Based on a couple of recent studies related to Viet Nam’s coffee industry, RMIT Tourism and Hospitality Management lecturer Vũ Thị Kim Oanh emphasised the efforts made by Vietnamese coffee stakeholders in the journey to bring Vietnamese coffee to the world.

“Many stakeholders in the industry have taken specific actions to contribute to bringing Vietnamese coffee to the world. For example, tour companies, hotels, and coffee businesses have collaborated to build an experience model of a “coffee path”, “from farm to cup”, or “from seed to cup” for visitors,” Oanh said.

Sharing experience from Les Vergers du Mekong company, known for its Folliet coffee brand, General Director Lê Văn Đông said that strong market knowledge, a focus on reducing adverse environmental impact, and technology application have been key to their sustainable success for the past two decades.

“We manage our supply chain very carefully. For instance, we have designed a traceability app, and frequently hold workshops and provide support to farmers so that our international quality standards are maintained. We also use eco-friendly packaging and are piloting organic farming. These are the basis for our competitive advantage and high sales,” Đông said.

Speaking at the forum, Trần Nhật Quang founder and CEO of Đà Lạt-based Là Việt Coffee, highlighted the potential of ‘in-country export’. When building their factory in Đà Lạt, Là Việt combined their production facilities with a coffee shop in one space, so that visitors can enjoy their coffee while learning through visitation about the production process and products.

“We have a two-hour tour of our factory and the roasting and brewing experience. We also have a one-day tour, which offers an in-depth experience for international tourists interested in local farming. This tourism model was very successful prior to COVID-19, and we intend to continue with it when travelling is enabled again,” Quang said.

Quang now has coffee stores in the most tourists in Việt Nam in Đà Lạt, Hà Nội and HCM City.

According to Nguyễn Văn Minh, Deputy Chairman of the Việt Nam Farms and Agricultural Enterprises Association, the coffee industry has been and will continue to be a mainstay in Viet Nam’s international business.

“Việt Nam is gearing towards a smart, organic and value-adding agricultural sector. The coffee industry is part of this trend. Việt Nam can improve the value of its coffee gradually by innovating, applying technology and creativity in new products, and attracting prestigious investors,” he said.

The International Business Forum is organised by RMIT annually since 2017 to bring together leading international and Vietnamese experts, policymakers and academics to discuss key themes in international business with a Vietnamese context.

Initiated by RMIT Associate Professor Nguyễn Quang Trung and chaired by Dr Abel Alonso, the annual forum aims to enhance the exchange of knowledge, useful experiences and best practices among domestic companies, multinational corporations, and key stakeholders in international business in Việt Nam. — VNS

Sugar companies enjoy sweet earnings

Many businesses in the sugar industry reported fruitful earning results for the fiscal year 2020-2021.

Lam Sơn Sugar Joint Stock Corporation (LSS) reported revenue of VNĐ831 billion (US$36.4 million) in the fourth quarter of the 2020-2021 fiscal year, with profit after tax of VNĐ16 billion, up 82.5 per cent and 120 per cent respectively. For the whole year, the company achieved revenue of VNĐ1.85 trillion, and profit after tax of VNĐ24 billion, up 9.3 per cent and 27 per cent respectively.

Sơn La Sugar JSC (SLS) achieved profit after tax of VNĐ164 billion for the whole year, up 38 per cent, but revenue decreased compared to the previous year, down 23.6 per cent to VNĐ801 billion. SLS exceeded its profit target for the year by VNĐ138 billion.

In the fourth quarter of the year, SLS recorded profit of VNĐ76 billion, up 31 per cent year-on-year and contributing 46.3 per cent to total annual profit.

Thành Công – Biên Hoà Joint Stock Company (SBT) reported revenue of VNĐ14.9 trillion, up 15.6 per cent, with profit reaching VNĐ674.6 billion, up 86 per cent.

In the fourth quarter, the company’s revenue reached more than VNĐ4.15 trillion, up 10.2 per cent over the same period last year. Profit after tax reached VNĐ195 billion, down 9.3 per cent.

SBT attributed the positive growth to the company’s effective sales policy, market share expansion in product segments and optimisation of supply chains and well-controlled input costs.

Kon Tum Sugar Joint Stock Company announced fourth-quarter revenue of VNĐ80.4 billion, equivalent to the same period last year.

However, thanks to the lower cost of goods sold, the company’s profit after tax reached VNĐ3.34 billion, a strong increase compared to VNĐ900 million the previous year. In the whole year, the company recorded a revenue of VNĐ248.2 billion, up 62 per cent year-on-year, and profit after tax reached VNĐ5.87 billion, up 196 per cent.

Rising prices

The strong recovery of world raw-sugar prices drove the positive results. According to the International Sugar Organisation (ISO), in the first half of June 2021, the price index of raw sugar and white sugar remained high.

The average price of white sugar in June was $449.1 per tonne, slightly lower than in May but still higher than in March and April. The average price of raw sugar over 6 months also rose from the previous months.

In the domestic market, sugar prices also benefited from a new policy.

The imposition of anti-dumping and anti-subsidy taxes by the Ministry of Industry and Trade on sugar from Thailand limited imports, making supply and demand more balanced, pushing up sugar prices.

Lê Trung Thành, vice chairman of Lam Sơn Sugar Joint Stock Corporation Board of Directors, said that the price of finished sugar had increased by 20 per cent compared to the same period last year.

“LSS has careful preparation steps, expecting a new fiscal year with more prosperous business results,” he said.

Thành said the company spent VNĐ30 billion to invest in growing sugarcane, fertiliser and farming techniques. As a result, the number of farmers returning to sugarcane farming increased by about 20 per cent compared to the previous year, ensuring growth in the new period.

The purchase price of raw sugar cane had increased sharply in recent years, from 900,000 to VNĐ1.1 million per tonne, and was expected to increase to VNĐ1.2 million per tonne in the new crop, he said.

However, in the short term, sugar enterprises were facing challenges due to the fourth outbreak of COVID-19. If the pandemic was well controlled, all production and business activities would return to normal, especially the sugar enterprises as they mainly served the domestic market, he said.

“The transportation of goods to factories is also limited, drivers must comply with regulations on disease prevention and COVID-19 testing,” he added.

An industry insider said when the Ministry of Industry and Trade applied anti-subsidy and anti-dumping taxes on sugar imported from Thailand, there were cases of more sugar being imported from other countries such as Malaysia, Indonesia and Cambodia.

The imposition of anti-dumping and anti-subsidy taxes on refined and raw sugar imported from Thailand would last for five years, officially effective from June 16, 2021, he said. This was expected to remove difficulties and challenges for local sugar businesses who had to compete with cheap Thai sugar flooding the domestic market. VNS

VN set targets of developing offshore wind power by 2045

Việt Nam is striving to produce about 3,000-5,000 MW of offshore wind power by 2030 and 21,000 MW by 2045, experts said during a webinar.

The webinar was held on Wednesday with a view to gather policymakers, researchers and businesses and organisations to exchange views on the prospects of offshore wind power, as well as holding discussions on environmental and social impact assessment regulations in Việt Nam.

Addressing the seminar, Chairman of the Việt Nam Union of Science and Technology Associations (VUSTA) Phan Xuân Dũng said the country would benefit from the development of offshore wind power, whose cost would gradually decrease in the future. And the development would also help create new jobs, attract investment, and reduce carbon emissions.

Many at the event said the country still lacked legal regulations on environment impact assessment and technical standards for the production, installation, operation, and maintenance of offshore wind power despite having a lot of potential.

An insufficient legal basis has resulted in differences between domestic environment impact assessment and international standards, according to Cao Thị Thu Yến from the Việt Nam Initiative for Energy Transition (VIET).

Yến noted offshore wind power projects occupying a vast area might overlap with other activities in oil and gas exploitation, telecommunications, and habitats of seabirds, fish, and coral, among others. She added investors, therefore, should consider environmental and social regulations for good compliance in addition to information on investment cost and license time.

Nguyễn Chu Hồi, deputy head of the Việt Nam Fisheries Society (VINAFIS), stressed the importance of singling out projects that harm the maritime environment, ecology, and fishing. Therefore, concise and detailed regulations would enable the authorities to do that in an easy way.

Hồi said: “The environmental impact assessment must be done carefully, for example, on how the impact of underwater sound on corals and sea creatures is and how to avoid overlapping development of wind power, oil and gas, and fishing.”

Deputy General Director of Russia-Vietnam Joint Venture (Vietsovpetro) Vũ Mai Khanh said the role of State-run agencies in verifying environment impact assessment and supervising the projects is essential to the development of the projects.

Andy Ho, head of Government and Regulatory Affairs, Asia-Pacific New Markets at Danish multinational power company Ørsted A/S, recommended that environment impact assessments should be in line with international standards to facilitate the investment.

Yến from VIET said there is a need to issue a legal document that meets international standards to make EIA the foundation for the authorities’ decisions on licensing and supervising offshore wind power projects.

According to experts, a mechanism for offshore wind power purchase is also necessary to stimulate this market.

They also suggested the State devise a specific mechanism for developing offshore wind power farms since this type of renewable energy will generate sustainable benefits, helping to guarantee energy security and promote citizens’ sense of responsibility towards the protection of Việt Nam’s maritime sovereignty. – VNS

Việt Nam strives to be a global seafood processing centre

Việt Nam is aiming to become one of the world’s top five seafood processing countries.

The Prime Minister recently issued Decision 1408/QĐ-TTg approving the development of the seafood processing industry over the next 10 years.

The plan aims to develop a modern, efficient and sustainable seafood processing industry, meeting the needs and regulations of the consumption market; improve competitiveness and continue to integrate deeply into the global value chain.

The target is for the growth rate of processed seafood production to reach more than six per cent per year by 2030.

The proportion of export value of value-added processed seafood products reached an average of over 40 per cent, in which shrimp reached 60 per cent, pangasius 10 per cent, tuna 70 per cent, squid and octopus 30 per cent, and other aquatic products 30 per cent.

The scheme aims to form a number of modern seafood processing corporations and enterprises, with economic potential and management level at a world-class standard.

The value of seafood processing for domestic consumption is expect to hit VNĐ40 – 45 trillion (US$1.7 – 1.9 billion), contributing to the value of seafood export turnover of about $14-16 billion.

To achieve the objectives, the plan sets out necessary tasks such as organising the control and development of raw materials for aquatic product processing from farming, exploitation and importation to meet the needs of processing enterprises and suitable for domestic consumption and export demand; comply with the conditions and regulations of Việt Nam and international practices; ensure the requirements of traceability, avoid origin fraud, and trade fraud.

It also set a goal to attract investment to form large seafood processing corporations and companies with economic potential and world-class management; step up the processing of products with high added value, which focus on key product groups and develop seafood consumption market.

The scheme has six projects, priority tasks for implementation with a total cost of VNĐ420 billion. — VNS