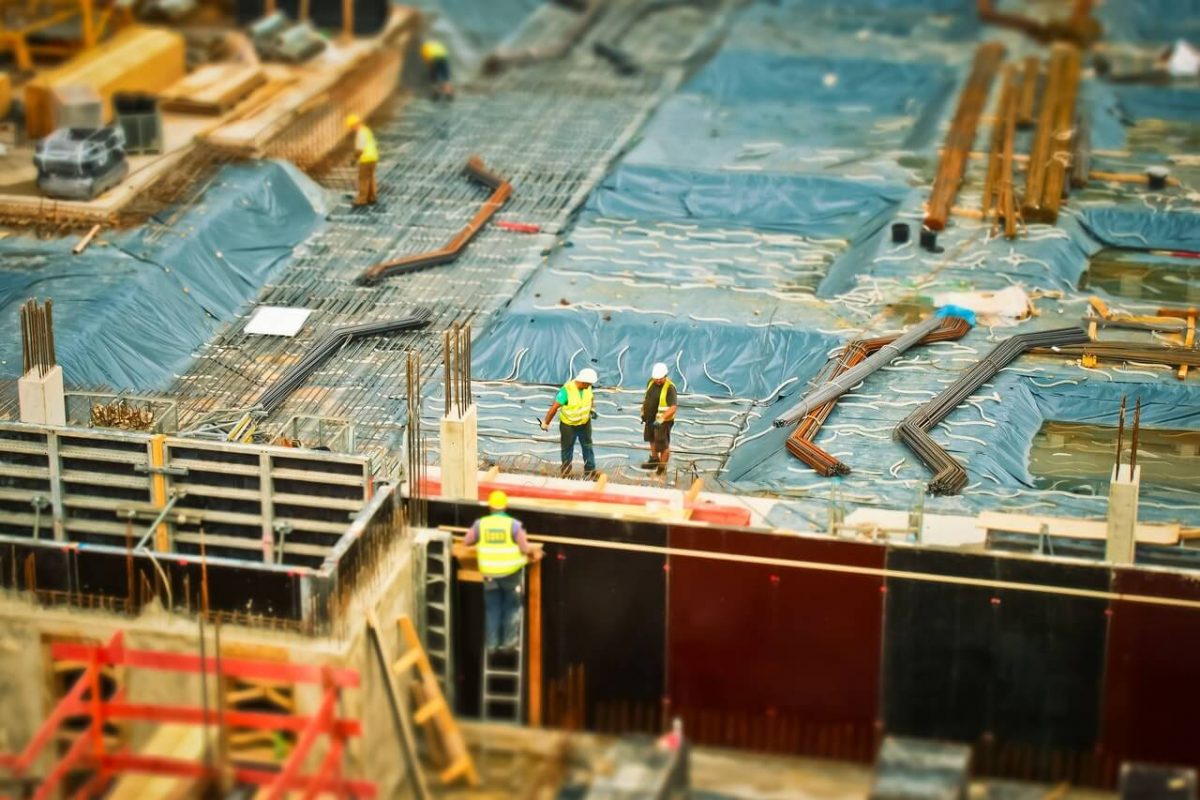

Lower steel prices and public investment disbursement are expected to be growth momentum of the construction industry in the rest of 2022.

Lower steel prices and public investment disbursement are expected to provide growth momentum for the construction industry over the second half of 2022.

After hovering around VNĐ18,000 – 19,000 a kilo (US$0.77 – 0.81 per kilo), the price of construction steel has cooled down to the same levels as last year.

On July 9, steel producers, including Hoa Phat Group, Vietnam – Italy Steel and Vietnam Germany Steel Pipe, reduced steel prices for the eighth time in a row in two months.

Accordingly, the price of coils and rebars declined to VNĐ16,000 – 16,500 per kilo, about 8-9 per cent lower than that in early May and down 13-15 per cent compared to the beginning of March.

Vietnam Steel Association (VSA) said that the recent downtrend was thanks to the continuous decrease in raw material prices since the end of March, causing the market to slow down. Distributors seek to reduce inventories, so the factories’ outputs are much lower than usual.

SSI Securities Corporation said that after advancing 15 per cent in the first quarter due to pent-up demand, domestic steel consumption volume, including construction steel, galvanised sheet and steel pipe, dropped by about 32 per cent on-year in April and May.

Weaker demand due to persistent high steel prices and rising costs of other construction materials stalled operations, while concerns over record steel prices caused distributors to pause stockpiling and tightened management policies on capital inflows into the real estate sector.

VNDirect Securities Corporation expects the selling price of construction steel will gradually go down to the average level in the long term.

However, the prospect of a strong recovery in steel demand after the pandemic and high input material prices will make the sliding process longer than expected. Specifically, the average selling price of construction steel in 2022 and 2023 will be VNĐ16,100 and VNĐ14,500 a kg, respectively, down 5-15 per cent compared to the current price.

Construction businesses benefit significantly from the steel price movements. In the structure of construction costs, raw materials account for 65-70 per cent of the estimated construction expenses, of which steel and cement are the two most important materials.

However, the prices of cement still inch higher to VNĐ1.65 – 1.7 million a tonne due to higher costs of input materials such as coal, electricity, gasoline, gypsum, additives, packaging, freight rates and labour.

According to the Vietnam National Cement Association (VNCA), the prices of cement will continue to rise in the second half of the year as input costs are still at high levels and domestic consumption can increase again thanks to the acceleration in disbursing public investment and implementation of key transport infrastructure projects.