Additive manufacturing, commonly known as 3D printing, is gaining in popularity due to its broad scope of application, in industry, R&D, and for personal use. Here’s how this burgeoning new technology is evolving in Vietnam.

Additive manufacturing is a relatively new means of producing goods, yet has become incredibly popular around the world in a very short amount of time.

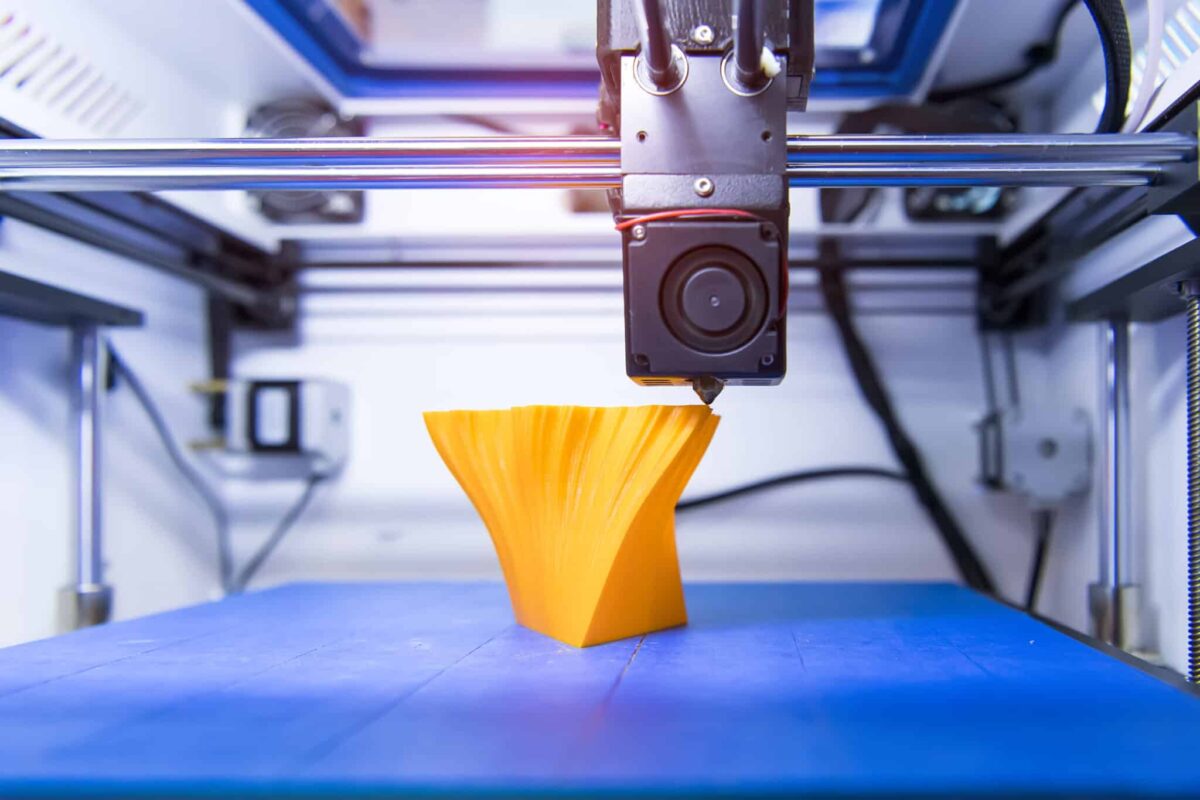

More commonly known as 3D printing, additive manufacturing takes raw materials in liquid form and essentially prints a component, product, or part – layer by layer. This technology has been used around the world for myriad applications from houses to, controversially, guns.

In manufacturing hubs like Vietnam, this new technology has the potential to be a changemaker. It can produce parts and components for a fraction of their traditional cost, by limiting wastage and reducing the need for labor.

With this in mind, the potential for additive manufacturing to dramatically disrupt the manufacturing industry is clear and as a result, it has drawn a lot of attention in Vietnam. This is in both using additive manufacturing in production processes and in developing additive manufacturing technology.

In this light, it’s not only important but can be valuable for manufacturing firms in Vietnam to understand the key industry drivers of additive manufacturing, how the industry is developing, and what impact additive manufacturing might have on Vietnam’s enormous manufacturing industry.

Additive manufacturing in Southeast Asia

To understand additive manufacturing in Vietnam, it’s first important to understand how additive manufacturing is developing in the region.

At present, additive manufacturing penetration in Southeast Asia is relatively small. It’s estimated that this new technology only accounts for around 5-7 percent of the US$3.8 billion invested in additive manufacturing in Asia in 2019, according to technology and engineering firm thyssenkrupp.

There is huge potential for the region, thyssenkrupp says, estimating that the sector will generate US$100 billion of incremental value by 2025 impacting the GDP of the Southeast Asian region to the tune of 1.5-3 percent of real GDP. It goes on to say that additive manufacturing could see dependence on imports reduced by up to 2 percent for the region.

This could see the region’s dependence on its neighbor to the north and the world’s second-biggest economy, China, reduced. That would take some of the pressure off with respect to the control China asserts over regional trade.

Additive manufacturing in Vietnam

As a regional manufacturing powerhouse, Vietnam stands to be one of the most heavily impacted economies with respect to the rise of additive manufacturing technology. This could be either a good or a bad thing. On the one side, automation may cost the manufacturing sector jobs, but on the other, Vietnam may be able to position itself on the cutting edge of the design and manufacture of additive manufacturing equipment.

Additive manufacturing in Vietnam is currently most acutely visible in the automotive, consumer goods, and electronics sectors. These sectors all have vast manufacturing operations in the Southeast Asian nation and stand to benefit immensely from 3D printing technology.

These sectors are typically heavily invested by foreign firms and it is common for these firms to import their own 3D printing technology. Vietnam, however, is also working toward developing its own additive manufacturing products and services.

In fact, there are a number of events and initiatives in place in Vietnam to promote this new technology and educate Vietnamese firms and businesses about its perks and benefits. These include:

3D Print Fiesta

Held annually, the 3D Print Fiesta event is the self-proclaimed ‘place to go for the entire 3D printing and additive manufacturing industry’. This year the event will be held in Binh Duong, a key manufacturing center in Southern Vietnam. Among big-name brands manufacturing in Binh Duong are the likes of sportswear heavyweights Nike and Adidas through networks of contract suppliers. The event is expected to showcase additive manufacturing machines, 3D printers, and a range of other products in the field.

Saigon Hi-Tech Park Incubation Center

This innovation hub in Ho Chi Minh City supports domestic startups in developing their products, finding investors, commercializing their products, and scaling up their operations. The park has a broad range of projects currently being developed, including assisting 3D printing firm Meetech in developing its products and services.

HCMC University of Technology

The Ho Chi Minh City University of Technology (HUTECH) is also an active facilitator in the development of additive manufacturing technology in Vietnam. HUTECH has held workshops and produced a number of academic papers on additive manufacturing.

Firms offering 3D printing technology and services in Vietnam

There are a broad range of companies now offering 3D printing technology services in Vietnam. Notably many foreign corporations import their own equipment, particularly high-tech manufacturing nations like Japan and South Korea. However, homegrown AM technology is also growing in prominence. Three local firms producing 3D printing technology are:

Meetech

MEETECH was founded in 2014 and offers 3D printing consulting, 3D design, and 3D printing services, alongside providing 3D printing equipment. Based in Vietnam’s manufacturing heartland, Ho Chi Minh City, this firm has the support of the aforementioned Saigon Hi-Tech Park Incubation Center.

3D Maker

Founded in 2014, 3D Maker is an additive manufacturing specialist in HCMC. It specializes in additive manufacturing research and the production and commercialization of 3D printers. 3D Maker boasts among its clients the Masan Group. Masan is one of the biggest players in Vietnam’s food and beverage market and uses 3D printing in product development, according to 3D Maker’s website.

Scantech Vietnam

Scantech Vietnam first started operating in 2012. Based in Hanoi, it currently offers 3D printing equipment and services, 3D Scanning, and 3D software. This 12-year-old firm is an authorized vendor of key suppliers from all over the world including the USA, Germany, and S. Korea.

Support policies for additive manufacturing development in Vietnam

Vietnam has for a long time been determined to embrace the Fourth Industrial Revolution. Keen to become a high-tech manufacturer of globally in-demand goods, Vietnam has put in place a number of policies and initiatives to incentivize and support businesses with the eventual aim of transforming the domestic economy. These include:

National Digital Transformation Programme by 2025

The National Digital Transformation Programme by 2025, with an orientation towards 2030, forms the backbone of Vietnam’s digital transformation initiative. This document is designed to facilitate awareness, support enterprises in developing transformation strategies, and provides incentives for businesses to upgrade their plants, equipment, and processes.

National Innovation Center

Established through Decision 1269/QD-TTg, the NIC is at the center of Vietnam’s push to develop the domestic startup sector. The NIC provides training and support for young enterprises and partners with international technology companies like Amazon and Google.

National Technology Innovation Fund (NATIF)

NATIF is a government agency and financial institution under Vietnam’s Ministry of Science and Technology that provides grants and preferential loans for research and development, innovation, and technology transfers.

Utilizing additive manufacturing in Vietnam

Traditionally, Vietnam has been an attractive destination for manufacturers due to its tax incentives and low-cost workforce. But this is changing. Wages are rising and tax incentives may be a thing of the past when the global minimum tax comes into force in the near future. In this light, additive manufacturing can be an effective means of mitigating rising labor costs.

Furthermore, demand for additive manufacturing machinery and equipment, particularly from well-known and established international brands, is likely to increase among domestic firms. International manufacturers of 3D printing equipment could potentially find a lucrative market in this burgeoning Southeast Asian nation.