BUY VIETNAM THIS MONTH

HEADLINES

Vietnam’s Carbon Market: Progress Report

During COP26, Vietnam made a commitment to attain net-zero carbon emissions by 2050, with a carbon market being touted as one of the most efficient strategies to achieve this objective.

Carbon markets raise the cost of carbon emissions, resulting in increased business expenses. This should motivate companies to reduce their environmental impact to improve bottom-line growth.

Further, carbon trading can generate economic advantages for the national economy. The global carbon credits market exceeded US$909 billion last year, with permits exchanged for 12.5 billion tons of carbon.

Yet, despite the potential financial gains from carbon trading, only the province of Quang Nam in Vietnam has so far pursued this opportunity.

This may be about to change, as the push to develop a domestic carbon market starts to get traction.

Vietnam’s carbon credit market plan

From 2015 to 2020, Vietnam was a part of the Partnership for Market Readiness (PMR). This was a program supported by the World Bank and designed to help establish legal frameworks and pilot markets for carbon that could be integrated with international carbon markets.

This was followed, on December 21, 2021, by Decision No.2157/QD-TTg, which established a National Steering Committee charged with ensuring that Vietnam meets the commitment it made at COP26. This marked Vietnam’s first legislated step toward realizing its ambitious goal.

This was further supplemented by Decision No. 01/2022/QD-TTg, which mandated a list of sectors and facilities that must conduct greenhouse gas inventories, including energy, transportation, construction, industrial processes, and agriculture-forestry.

Most recently, Decree 06/2022/ND-CP dated January 7, 2022 provided clear regulations for the development of Vietnam’s carbon market. It specifies two key periods:

• 2023-2027: Developing regulations on carbon credit management, quota exchange activities and carbon credit; developing regulations on the operation of carbon credit trading floors; piloting implementation of the mechanism of exchange and clearing of carbon credit from 2025.

• 2028: Officially operating a carbon credit trading floor; connecting the domestic carbon market with others in Asia and the global market.

Thus, from 2028, if factories and businesses cannot reduce their carbon output, they will have to purchase carbon credits to offset their emissions. Failure to do so may see those firms hit with administrative fines.

Vietnam’s carbon market participation so far

Vietnam has indirectly participated in carbon credit trading activities through several schemes and projects, such as the Clean Development Mechanism (CDM) adopted under the Kyoto Protocol and the European Union Emissions Trading Scheme (EU-ETS).

The CDM project allows developing countries like Vietnam to earn saleable certified emissions reduction (CER) credits in order to meet Kyoto reduction targets. As of June 2020, Vietnam ranked 4th in the number of CDM Executive Board projects in the world with 257 projects accounting for 140 million tons of carbon dioxide.

Vietnam has also taken part in this field through the Joint Crediting Mechanism (JCM) with Japan and the Program on Reducing Emissions Through Reducing Deforestation and Degradation (REDD+).

Since the implementation of JCM in 2013, Vietnam has been producing ten million tons of carbon dioxide credits per year for Japan through 28 projects. Vietnam ranks 4th in the number of credits among the participating countries and this also gives it the opportunity to access Japanese energy-saving and emissions-reducing technologies.

With regard to REDD+, Vietnam was the first country in the Asia-Pacific region to be recognized as eligible for payments for emissions reduction efforts in 2018.

Benefits of a carbon credit market for Vietnam

Reducing emissions and deforestation

Tropical deforestation represents 11 percent of human-caused greenhouse gas emissions. Meanwhile, protecting and restoring tropical forests could account for up to 30 percent of the emissions reductions needed to stave off global warming.

A mature tree over 30 meters tall can absorb and store about 22 kg of carbon dioxide a year. Under the REDD+ scheme one ton of carbon dioxide equals one carbon credit, or 1 carbon credit for every 41 mature trees.

As a country with almost 15 million hectares of forest, Vietnam’s forestry sector can play an important role in not only reducing greenhouse gas emissions but also generating revenue from the market for carbon credits.

Revenue from forest carbon credits could prove to be very profitable for Vietnam. However, this will require finding ways to protect these areas and to reduce deforestation. Planting more trees to increase forest acreage could be one way to offset the impacts of deforestation.

Economic benefits for forest-based communities

Lots of Vietnamese agricultural firms from large corporations to smaller startups have also expressed an interest in a carbon credit market. Sokfarm, for example, is looking to sell carbon credits from coconut trees. This may have the added benefit of reducing hardships and mitigating risks posed by climate change for farmers.

Quang Nam is the first locality in Vietnam licensed by the government to carry out a pilot project for developing forest carbon credits.

Quang Nam’s natural forest area is 466 hectares. If one cubic meter of forest trees is equal to 1.1 tons of carbon, after the pilot phase this project could help Quang Nam earn up to US$5 million per year at a selling price of US$5/ton carbon dioxide equivalent (CO2e).

However, despite billions of dollars spent on carbon removal, the profit from selling carbon credits is still not high enough to persuade a critical mass of owners to discontinue clearing forests.

This is due to increasing demand for wooden furniture in both domestic and global markets and higher prices as a result – in the first 11 months of 2022, wood and wooden products exports of Vietnam were worth an estimated US$14.6 billion, increasing 9 percent over the same period in 2021.

Creating advantages for export activity and FDI

With a boom in demand in Asia for carbon credits following COP26, the voluntary carbon market is opening export opportunities for Vietnamese carbon capture companies.

For instance, Singapore chose to develop a voluntary market allowing domestic businesses to purchase international carbon credits to offset taxable emissions. This plan should help Singapore become a major regional carbon services and trading hub in the region.

This may provide opportunities for Vietnamese firms to create high quality carbon credits and sell them to enterprises in Singapore to help them cover their carbon offset obligations.

A domestic carbon market may also boost exports in major markets like the EU and the US, while also helping Vietnamese products avoid emissions-based import taxes.

The EU’s Carbon Border Adjustment Mechanism (CBAM) is a prime example of this tax. It enforces a tariff on carbon-intensive imports, leveling the playing field for EU firms that adhere to emissions trading regulations.

While this strategy is still in its nascent stage, cross-border emissions-based trade barriers like this are predicted to gain popularity in the future.

Prospects in Vietnam’s future carbon market

Creating a carbon credit market in Vietnam will be highly beneficial for the carbon capture industry and, more crucially, the environment.

By reducing greenhouse gas emissions, a successful carbon trading market will aid Vietnam in fulfilling its COP26 commitments while enabling individuals and businesses to profit from selling credits overseas.

Despite the absence of a carbon market in Vietnam at present, the groundwork is being laid, and carbon emissions management is steadily advancing towards this goal.

The move is not only necessary for Vietnam to achieve its climate commitments but also to ensure seamless international trade.

Hai Phong commits to attractive environment for EU investors

The northern port city of Hai Phong is striving to create an attractive business environment for foreign investors, especially those from the European Union (EU), affirmed Secretary of the municipal Party Committee Le Tien Chau.

During a local working session on April 20 with a delegation led by Ambassador Giorgio Aliberti, Head of the EU Delegation to Vietnam, Chau said with its geographical, political and economic advantages as well as high level of economic openness, Hai Phong is becoming an attractive destination for both domestic and foreign investors.

At present, the EU member states are all advanced in new industries such as renewable energy and high-tech industries, with strengths in supply chain and logistics, green economy, digital economy, and circular economy. These are essential fields for the industrialisation and modernisation of Vietnam and Hai Phong in particular, the official said.

According to him, Hai Phong is aiming to become an international city that is comparable with the top cities in Asia, leading the country in industrialisation and modernisation.

Chau believed that there remains ample room for ties between Hai Phong and EU partners to grow further.

He wished that in the near future, ambassadors of EU countries would continue serving as an important bridge to boost all-around cooperation between Hai Phong and EU nations, and encourage firms in the bloc to invest in high-quality projects in Hai Phong.

Hai Phong is committed to all possible support for EU firms to do business in the city, he said.

The host also sought their specific assistance in net zero emissions by 2050, logistics, maritime, culture, health care and education.

Expressing their impression on the city’s provincial competitiveness index, the guests lauded Hai Phong as one of the attractive and important destinations for European investors. They discussed improving business environment related to the implementation of the EU-Vietnam Free Trade Agreement.

Aliberti stressed that via the visit, the EU Delegation will work to assist Hai Phong in the development of green economy, circular economy, renewable energy, logistics and infrastructure.

At present, the EU investors have poured over 160 million USD into 18 projects in local industrial parks and economic zones. Apart from them, there are 32 EU-funded projects worth 927.6 million USD in the city.

EXPORT-IMPORT IN 2023 Jan to March

Sweden exports to Vietnam

| Products | 3M/2022 | 3M/2023 | Change (%) |

|---|---|---|---|

| All products (USD) | 94,926,179 | 77,955,503 | -17.9 |

| Other petroleum products | 539,345 | 827,602 | 53.4 |

| Other machinery, equipment, tools and spare parts | 31,426,769 | 26,914,125 | -14.4 |

| Pharmaceutical products | 27,438,087 | 19,134,720 | -30.3 |

| Paper products | 5,530,871 | 5,864,437 | 6 |

| Iron or steel | 5,205,451 | 3,103,056 | -40.4 |

| Chemical products | 3,317,440 | 3,009,510 | -9.3 |

| Wood and articles of wood | 2,241,751 | 1,970,375 | -12.1 |

| Articles of iron or steel | 1,085,576 | 1,712,712 | 57.8 |

| Plastic products | 983,869 | 1,273,193 | 29.4 |

| Computers, electrical products, part thereof | 939,618 | 1,104,254 | 17.5 |

| Plastic materials | 1,184,443 | 503,650 | -57.5 |

| Telephone sets, parts thereof | 44,168 | - | -100 |

| Others | 14,988,791 | 12,537,869 | -16.4 |

Sweden imports from Vietnam

| Products | 3M/2022 | 3M/2023 | Change (%) |

|---|---|---|---|

| All products (USD) | 262,622,478 | 224,147,980 | -14.7 |

| Telephone sets, parts thereof | 88,630,069 | 120,416,645 | 35.9 |

| Textiles and garments | 28,157,117 | 24,302,991 | -13.7 |

| Machinery, mechanical appliances, equipment, parts thereof | 21,659,490 | 21,330,705 | -1.5 |

| Computers, electrical products, part thereof | 19,231,685 | 20,590,192 | 7.1 |

| Footwears, parts of such articles | 25,399,288 | 8,892,768 | -65 |

| Bags, purses, suitcases, hats, umbrellas | 7,656,726 | 5,672,051 | -25.9 |

| Wood and articles of wood | 9,360,939 | 5,047,523 | -46.1 |

| Articles of iron or steel | 43,404,511 | 4,981,524 | -88.5 |

| Fish and crustaceans, molluscs and other aquatic invertebrates | 4,885,331 | 3,816,846 | -21.9 |

| Plastic products | 4,281,619 | 3,141,940 | -26.6 |

| Products of rattan, bamboo, sedge and carpet | 3,330,581 | 2,153,093 | -35.4 |

| Toys, sports equipment and parts | 2,855,577 | 2,131,777 | -25.3 |

| Materials for textiles and garments, and footwares | 2,036,507 | 755,765 | -62.9 |

| Ceramic products | 1,211,011 | 675,395 | -44.2 |

| Rubber | 190,425 | 124,891 | -34.4 |

| Other metals and products | 331,602 | 113,874 | -65.7 |

| Others | 39,763,354 | 28,422,271 | -28.5 |

Denmark exports to Vietnam

| All products (USD) | 54,114,984 | 51,830,917 | -4.2 |

|---|---|---|---|

| Other machinery, equipment. tools and spare parts | 14,447,132 | 12,125,532 | -16.1 |

| Pharmaceutical products | 5,589,100 | 1,892,869 | -66.1 |

| Chemical products | 5,464,253 | 6,090,296 | 11.5 |

| Fish and crustaceans, molluscs and other aquatic invertebrates | 3,830,848 | 9,035,676 | 135.9 |

| Computers, electrical products, part thereof | 2,313,803 | 609,696 | -73.6 |

| Articles of iron or steel | 2,267,953 | 640,571 | -71.8 |

| Plastic products | 1,830,074 | 1,171,859 | -36 |

| Milk and dairy products | 965,746 | 612,062 | -36.6 |

| Electric wires and cables | 813,022 | 381,519 | -53.1 |

| Iron or steel | 74,195 | 59,261 | -20.1 |

| Materials for textiles and garments, and footwares | 59,295 | - | -100 |

| Others | 16,459,563 | 19,211,576 | 16.7 |

Denmark imports from Vietnam

| Products | 3M/2022 | 3M/2023 | Change (%) |

|---|---|---|---|

| All products (USD) | 120,853,125 | 81,981,187 | -32.2 |

| Textiles and garments | 20,495,894 | 17,566,688 | -14.3 |

| Fish and crustaceans, molluscs and other aquatic invertebrates | 17,800,678 | 10,589,157 | -40.5 |

| Wood and articles of wood | 16,005,250 | 8,016,581 | -49.9 |

| Furniture products from materials other than wood | 9,631,966 | 7,489,621 | -22.2 |

| Footwears, parts of such articles | 5,830,563 | 4,537,301 | -22.2 |

| Other machinery, equipment, tools and spare parts | 8,384,661 | 4,528,067 | -46 |

| Plastic products | 5,493,735 | 4,079,077 | -25.8 |

| Electric wires and cables | 3,573,652 | 3,233,972 | -9.5 |

| Articles of iron or steel | 4,231,959 | 3,105,488 | -26.6 |

| Toys, sports equipment and parts | 2,653,921 | 1,852,600 | -30.2 |

| Bags, purses, suitcases, hats, umbrellas | 3,396,251 | 1,677,625 | -50.6 |

| Ceramic products | 2,227,690 | 1,575,224 | -29.3 |

| Transport vehicles and spare parts | 1,957,246 | 1,516,487 | -22.5 |

| Products of rattan, bamboo, sedge and carpet | 2,851,657 | 1,351,986 | -52.6 |

| Coffee | 628,979 | 798,163 | 26.9 |

| Others | 15,689,023 | 10,063,150 | -35.9 |

Norway exports to Vietnam

| Products | 3M/2022 | 3M/2023 | Change (%) |

|---|---|---|---|

| All products (USD) | 91,369,208 | 102,829,636 | 12.5 |

| Fish and crustaceans, molluscs and other aquatic invertebrates | 51,969,561 | 69,940,412 | 34.6 |

| Other machinery, equipment. tools and spare parts | 19,498,202 | 10,778,010 | -44.7 |

| Fertilizers | 5,620,302 | 5,476,918 | -2.6 |

| Articles of iron or steel | 1,584,717 | 3,548,792 | 123.9 |

| Chemical products | 931,716 | 1,224,462 | 31.4 |

| Others | 11,764,710 | 11,861,042 | 0.8 |

Norway imports from Vietnam

| Products | 3M/2022 | 3M/2023 | Change (%) |

|---|---|---|---|

| All products (USD) | 32,237,464 | 89,962,048 | 179.1 |

| Transport vehicles and spare parts | 318,621 | 61,762,210 | 19284.2 |

| Textiles and garments | 4,145,843 | 6,823,391 | 64.6 |

| Other machinery, equipment, tools and spare parts | 748,629 | 2,195,229 | 193.2 |

| Cashew nuts | 2,231,939 | 2,032,369 | -8.9 |

| Footwears, parts of such articles | 5,862,648 | 1,956,316 | -66.6 |

| Cameras, camcorders and components | 1,792,131 | 1,574,403 | -12.1 |

| Bags, purses, suitcases, hats, umbrellas | 1,138,866 | 1,436,560 | 26.1 |

| Plastic products | 1,484,007 | 1,358,876 | -8.4 |

| Fish and crustaceans, molluscs and other aquatic invertebrates | 3,158,784 | 1,104,490 | -65 |

| Furniture products from materials other than wood | 1,991,837 | 952,986 | -52.2 |

| Articles of iron or steel | 256,103 | 874,527 | 241.5 |

| Fruits and vegetables | 590,530 | 526,501 | -10.8 |

| Wood and articles of wood | 841,181 | 406,948 | -51.6 |

| Others | 7,676,345 | 6,957,242 | -9.4 |

EVFTA

Enterprises urged to enhance competitiveness to benefit more from EVFTA

Enterprises should focus on enhancing competitiveness by strictly complying with regulations on traceability and building brands to get more benefits from the EU – Việt Nam Free Trade Agreement (EVFTA) and promote sustainable exports to the bloc.

Hoàng Quang Phòng, Deputy Chairman of the Việt Nam Chamber of Commerce and Industry (VCCI), said at a conference on reviewing the two-year implementation of the EVFTA on Thursday that the first two years of EVFTA implementation was the time when the world and Vietnamese economies faced unprecedented fluctuations from the COVID-19 pandemic, disruption of supply chains, Russia – Ukraine conflict to the crises of food and energy.

He stressed that in that context, the trade deal played an important role in mitigating the adverse impacts of unprecedented fluctuations and helping improve the trade and investment relations between the two sides.

Việt Nam’s exports to the EU averaged $41.7 billion per year in the August 2020 – July 2022 period, 24 per cent higher than the average of the 2016-19 period when the EVFTA had not come into force. The proportion of export products that enjoyed preferential tariffs under the trade deal increased from 14.8 per cent in 2020 to 20.2 per cent in 2021 and 24.5 per cent in the first half of this year.

The FDI flow from the EU to Việt Nam was nearly $1.38 billion in 2020, a drop of 8.6 per cent against 2019, however, it saw a slight increase of 2.2 per cent in 2021 to reach $1.4 billion, making the EU the fifth largest foreign investor in Việt Nam.

Still, the EU’s investment in Việt Nam remained modest, accounting for just 0.35 per cent of the total investment abroad of the EU.

Nguyễn Cẩm Trang, Deputy Director of the Import-Export Department under the Ministry of Industry and Trade, said that the EVFTA contributed significantly to promoting exports of Việt Nam. Many products saw impressive growth in exports to the EU such as steel and iron by 739 per cent, cameras and components by 260 per cent, machinery and equipment by 82.3 per cent, rice, bamboo and rattan products by more than 50 per cent, ceramic and porcelain products by over 25 per cent, and vegetables and fruits by over 15 per cent.

There was still significant room for export expansion, Trang said, pointing out that Việt Nam’s export now made up for just 1 per cent of the EU’s imports.

Việt Nam had many products with advantages for export to the EU such as fruits, shrimp, tuna and other seafood products.

The report on the review of the EVFTA carried out by VCCI and FNF Institute on more than 500 enterprises found that nearly 41 per cent of enterprises said they enjoyed at least a benefit from EVFTA, Nguyễn Thị Thu Trang, Director of the VCCI’s WTO and Integration Centre, said.

The most common benefit was preferential tariff for import-export goods and positive effects in increasing orders, revenues and profits.

The report also found an improvement in enterprises’ understanding of the agreement with nearly 94 per cent having heard or known to different degrees about the EVFTA, the highest among existing FTAs.

Three out of every 10 enterprises know quite well and one very well about the EVFTA commitments related to their business operation. Looking to the future, 76 per cent expected that the EVFTA and other agreements would have impacts on their business prospects in the next three years and most were optimistic that the impacts would be positive.

Enterprises also pointed out obstacles that made it difficult for them to benefit from the EVFTA and other FTAs, including market fluctuations and uncertainties, limited competitiveness, lack of information about commitments and how to take advantage of these commitments.

VCCI also found nine legal documents were amended and issued to implement the EVFTA commitments, but the issuances were mostly slower than expected, which affected enterprises in the process of taking advantage of the EVFTA in the early phase.

Cao Xuân Phong from the Institute of Legal Studies said that it was necessary to hasten institutional reforms to implement the EVFTA and other new-generation FTAs more efficiently.

According to Trang, enterprises should be active in taking advantage of the EVFTA commitments through keeping a close watch on market developments, global economic fluctuations, Russia – Ukraine conflict and inflation risks to have production and business plans.

At the same time, it was necessary for enterprises to renovate production and business methods, and increase the application of technologies to create high-quality products and meet the requirements of the EU markets, Trang said.

Lê Xuân Sang, Deputy Director of the Việt Nam Institute of Economics, said trade promotion activities must be enhanced together with removing obstacles to enable enterprises to diversify export products and markets and participate in the EU’s supply chains.

Enterprises should also get prepared to cope with trade defence lawsuits, he said.

OTHER NEWS

Vietnam’s Agricultural Sector: Rising Star in Food Production

Vietnam has been selected by the United Nations to host the 4th Global Conference of the One Planet Network’s Sustainable Food Systems Programme in April this year. This will bring together experts from around the world to discuss how best to develop ‘sustainable, resilient, healthy, and inclusive food systems’.

At the same time, the World Economic Forum (WEF) has selected Vietnam as one of the first three countries to pilot the Food Innovation Hub, a flagship initiative of the Food Action Alliance designed to improve sustainability in food production.

As Vietnam becomes more visible on the global agricultural stage, we take a look at sector exports, opportunities for foreign investors, and some of the growth challenges moving forward.

Vietnam agricultural exports

In 2022, Vietnam’s agricultural sector experienced its highest growth in recent years reaching 3.36 percent. Of this figure, farming increased by 2.88 percent, fisheries increased by 4.43 percent, and forestry increased by 6.13 percent. The export turnover of the whole industry was over US$53.22 billion.

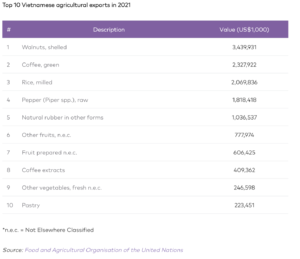

Vietnam currently exports a broad range of agricultural products all over the world. Its main exports are walnuts, coffee, and rice – accounting for just over US$5.7 billion worth of agricultural exports in 2021.

Funding development in agriculture in Vietnam

Overseas direct assistance (ODA) has played a key role in Vietnam’s agricultural growth coupled with the support of the Ministry of Agriculture and Rural Development (MARD).

By the end of 2022, MARD had approved four ODA projects or had investment policies with a total loan value of US$840 million. The ministry also coordinated with businesses to prepare 14 new project proposals requiring total capital of US$3.2 billion.

Last year, the agricultural sector also mobilized US$300 million in grant aid and approved 15 projects worth US$25 million for non-governmental organizations. It also attracted a large amount of FDI with 12 new projects and US$68 million in newly registered capital.

But more capital is needed and, with few restrictions on foreign investment in Vietnam’s agricultural sector (see below), foreign producers of agricultural products and their private finance may be necessary in order to facilitate the sector’s continued development.

Drivers of agricultural sector development

Government incentives and support

Decree No.57/2018/ND-CP on the mechanisms required to attract investment into agricultural and rural development forms the backbone of government policy aimed at increasing investment in the agriculture sector.

Decree 57 covers many types of new incentives for agricultural enterprises. These include:

- being exempted from payment of some fees;

- being exempted from payment of land rental and/or water surface in some instances;

- interest rate subsidies on commercial loans; and

- government funding for some facilities. For example, waste treatment, electricity, water infrastructure, as well as workshops and equipment required for some projects.

Furthermore, currently circulating is the Draft Strategy for International Cooperation in Agriculture and Rural Development to 2030.

The strategy is divided into three main groups of tasks and solutions:

- Proactive international integration;

- Strengthen partnerships; and

- Mobilizing external resources (read: FDI).

Free trade agreements

Vietnam is a part of 15 Free Trade Agreements (FTAs). This is opening markets like South Korea where, more than seven years after implementing the VKFTA, Vietnam has become the third largest mango supply market for S. Korea, reaching 1.7 thousand tons. This is equal to US$7.4 million.

As a result of the EVFTA that is now in place, Vietnam has also become the largest source of cashew nuts for the EU. In the first 10 months of 2022, Vietnam exported 98.97 thousand tons of cashews to European markets, worth US$699 million. This represents an increase of 9.8 percent over the same period in 2021.

Agricultural development barriers in Vietnam

Increased competition

Despite the benefits FTAs can present, they may be a double-edged sword.

With the quality standards system for Vietnam’s agricultural products still incomplete, Vietnamese goods can sometimes fail to meet the quality requirements of foreign markets.

Vietnam’s commitment to remove tariffs or reduce import taxes for a number of agricultural products also opens the domestic market to other key agricultural producers. Take the CPTPP, for example, which includes Australia, New Zealand, and Canada – all three huge primary producers.

This can create competitive pressure on the domestic agricultural industry with cheap produce and farmed goods arriving from countries with better farming technology and higher quality standards. Domestic producers therefore may be at a disadvantage if they cannot find financing to compete with bigger international players.

But this is a win for consumers with lower prices and a broader variety of products leading to better diets and a better quality of life. It would be unlikely then that protectionist policies would return to support domestic producers.

In this light, farmers may need to look outside of Vietnam for financing.

Climate change

One of the key challenges the agricultural sector faces is climate change. Vietnam is very vulnerable to the increasing consequences of climate change. This includes: droughts, floods, and saltwater intrusion. Adapting to these changes can be costly and will require modified farming techniques and new technologies, which come at a cost.

Local firms are already forking out millions of dollars for more advanced farming technology. TH Milk, one of Vietnam’s biggest dairy producers, is installing Israel computer technology on a number of farms around Vietnam to increase efficiency.

Similarly, Germany’s Bayer has a crop sciences branch operating in Vietnam developing sustainable, eco-friendly plant protection and hybrid seeds to increase productivity and decrease Vietnamese agricultures environmental footprint.

The Vietnamese agricultural sector may also face a shortage of high-skilled labor. As more workers move to secondary and tertiary sectors like manufacturing and services (tourism, finance, IT), the labor pool for agricultural workers is shrinking. This is in turn increasing the cost of Vietnam’s agricultural products.

Workers that remain in the sector are also usually older and/or without technical skills beyond traditional farming methods. They also often lack technological literacy, which can make it more difficult for modern farming techniques to be instituted and applied.

But this challenge, may be an opportunity for foreign collaboration and education investment. Institutions and startups from emerging and developed countries that offer advanced and niche agricultural education programs, training, and technology know-how may be tapped for upgrading Vietnam’s sector capability and human capital. This, coupled with Vietnam’s drive to further open and expand its education sector could see positive outcomes for both Vietnam and foreign investors.

Foreign investment in Vietnamese farms

As far as investment goes, plant-based agriculture does not carry any conditions for foreign investors. The establishment and registration of a foreign company wishing to invest in agriculture simply needs to comply with the standard investment, enterprise, and company laws.

That said, the 2013 Land Law, does not permit foreign investors to acquire land to build farms in Vietnam. Therefore, in order to establish a farm in the country, foreign investors can only rent the land. To do this they must establish a foreign invested enterprise, either alone or with a local partner.

Foreign investors and local partners may enter into an investment cooperation agreement in either the form of a joint-stock company or a limited liability company. They can also enter into a Business Cooperation Contract without having to establish a legal entity in Vietnam.

Foreign investors in Vietnam’s agricultural sector

A number of foreign investors are already making headway in Vietnam’s agricultural sector and many of them have been operating in the country for quite some time.

With the aforementioned limits on land ownership for foreign investors, international firms tend to be concentrated in either ancillary services or high-value goods, such as nuts, coffee, or fresh cut flowers.

Three firms that have been relatively successful in the Vietnamese market are Cargill, Olam, and the Louis Dreyfus Company.

Cargill

Since February 1995, American company Cargill has operated in Vietnam through Representative Offices in Hanoi and Ho Chi Minh City. It provides animal nutrition services and products as well as grain processing services. More than 1,500 people are employed by Cargill Vietnam, which has various locations around the country.

Olam

Olam is a global organization headquartered in Singapore. The company employs more than 6,500 employees in Vietnam’s central and southern provinces. Olam Vietnam has quickly established itself as one of the biggest exporters of cashew nuts, pepper, and coffee.

Louis Dreyfus Company

The France-based Louis Dreyfus Company has had a presence in Vietnam since 1998. It currently operates five facilities in Vietnam. These are:

- Lam Dong Robusta Coffee Buying Station,

- Lam Dong Arabica Coffee Mill,

- Daklak Robusta Coffee Buying Station,

- Pleiku Robusta Coffee Mill in Pleiku, and

- Orico Rice Mill in Dong Thap.

Vietnam’s agricultural products moving forward

Agriculture still plays a significant role in the Vietnamese economy, although it faces challenges including: climate change, a shortage of highly-skilled labor, and increased competition.

There are, however, a number of government incentives supporting the agricultural sector, as well as FTAs, that, though a challenge in many ways, are also opening up foreign markets to Vietnamese agricultural products.

With a strong commitment from the government to promote agriculture and the growing involvement of the private sector in this field, the prospects for the agricultural sector in Vietnam are promising.

Firms play an important role in fostering green growth

It is critical to promote the role of the business community in partnership with the Government of Việt Nam in fostering green growth, Deputy Minister of Planning and Investment Nguyễn Thị Bích Ngọc said at the technical session of the Vietnam Business Forum (VBF) on Friday.

Green growth and sustainable development have been identified as one of the focuses in the development policies of many countries around the world in recent years, Ngọc said, adding that Việt Nam was one among the pioneering countries in the region to approach the green growth model.

The Government’s national green growth strategy and the national action plan about green growth in the 2021-30 period set the goals of restructuring the economy in line with renovating the growth model to achieve economic prosperity, environmental sustainability and social fairness and toward a carbon neutral economy, contributing to limiting global warming.

Stressing that switching to a green economy was an inevitable trend and an important growth driver in the long term, Ngọc said Việt Nam was actively implementing a roadmap to amend the legal framework in order to raise green finance, promote green technology and investment and encourage the green transition toward a low-carbon emission economy.

In the process, the Government of Việt Nam affirmed the important role of the business community to achieving the goals of a green economy and sustainable growth.

Soren Roed Pedersen, Co-Chair of VBF, said Việt Nam was facing a number of difficulties and challenges to achieve the green growth targets, which required Government agencies and ministries to raise policies to promote the roles of economic sectors.

According to John Rockhold, Head of the VBF’s Power and Energy Working Group, Việt Nam achieved impressive economic growth in 2022 in the context of global uncertainties with GDP expanding by 8.02 per cent, compared to an increase of 2.58 per cent in 2021, the highest annual growth rate since 1997.

What happened over the past year highlighted the urgent need to accelerate the energy transition as an energy system that was heavily dependent on fossil fuels could significantly impact costs in the global economy.

Việt Nam was no exception in the energy transition trend.

“We recognise the desire of the Vietnamese Government to accelerate the energy transition so that it can meet the requirement for economic development and achieve the goal of becoming a high-income country by 2045,” he said. “The energy transition also brings job opportunities and this trend will create necessary conditions for the development of renewable energy.”

David John Whitehead from the VBF’s Agriculture Working Group said that rising inflation in foreign markets, including the US and Europe, made the demand for seafood import drop from the last quarter of 2022 and the trend might continue until the end of the first quarter of this year.

He predicted that the global economy would recover in the second half of this year, urging Việt Nam to continue to diversify markets. In addition, markets would have stricter requirements, which would force agriculture to improve adaptability and grab opportunities to develop sustainably with a focus on environmental protection and circular agriculture as a part of the circular economy.

According to Ngọc, the Government, ministries, agencies and localities would create the most favourable conditions in terms of mechanisms and policies for enterprises to achieve the harmonisation of green and sustainable growth and socio-economic recovery.

FDI projects go green

As Việt Nam has made a strong commitment to carbon emission neutrality by mid-century, foreign direct investments in the country have begun to go green to join the efforts.

One such investment was the new LEGO factory in Bình Dương Province, which is currently under construction.

LEGO Group said it aims to bring the factory up to the LEED Gold standard, which covers all areas of sustainability including energy, water, and waste. The factory will be designed to accommodate electric vehicles and be geared toward energy-efficient equipment.

The factory will also feature solar panels on its roof and a solar farm in close proximity. Combined, these solar facilities will generate enough energy to meet the factory’s full power needs.

LEGO Group also said it had been planting 50,000 trees in three years to compensate for the vegetation that would be removed during construction. The move was part of its effort to ensure the factory has a minimal impact on the environment.

“We are exploring many other initiatives that will make our new site a global lighthouse for sustainable operations,” said Preben Elnef, Vice President and Programme Lead for LEGO Group in Việt Nam.

DHL Express is another name in the vanguard of green transition in the country.

The world’s leading express service provider has inaugurated its latest service centre in Hà Nội, which is equipped with a wide range of technologies to minimise carbon footprint and maximise operational efficiencies.

These include green air-conditioning systems utilising variable refrigerant volume technology, helicopter fans, and electric vehicles.

The express service heavyweight said it had repeatedly redefined logistics, from pioneering the first green logistics product to becoming the first logistics company to commit to a zero-emissions target.

Pandora, the world’s largest jewellery brand, followed suit with a memorandum of understanding to build a new crafting facility in Bình Dương Province. The facility will be constructed in line with the LEED Gold standard and be powered fully by green energy.

EuroCham Chairman Alain Cany said the growing interest in sustainable development among European investors would open up more investments to Việt Nam in the short term, given its commitment to net-zero targets by 2050.

He revealed that EuroCham was implementing an investment promotion programme to bring 300 European green-growth-centered firms to Việt Nam to seek business opportunities. Their feedback is positive so far.

The chairman also said regarding green transition, Việt Nam could get ahead of other regional countries with its policies highly in favour of sustainable development.

The recent report prepared by Việt Nam’s Association of Foreign Invested Enterprises shows that 53.5 per cent of foreign-invested enterprises in Việt Nam have embraced green growth.

However, their green transition is not broad-based but limited to discrete activities such as building a standalone waste treatment plant or an incinerator furnace for waste disposal.

The report calls for more favourable policies to attract FDI flows into green growth, digital transition, and supply chain integration.

It also urges Việt Nam to legislate the Global Minimum Corporate Tax, step up administrative reform, and improve infrastructure facilities to redouble the effort.

Norway funds Việt Nam’s hybrid rice farming for climate change adaptation

A project will be launched in Việt Nam with a budget of US$477,460 funded by the Norwegian Government and $310,000 from institutes and universities, to establish a rice seed bank, develop new rice populations, create rice genetic diversity from superior hybrid rice.

Cần Thơ University in collaboration with the Global Crop Diversity Trust held a seminar in the Mekong Delta city of Cần Thơ on Monday to discuss biodiversity for opportunities, livelihoods and development in Việt Nam.

The theme of the event was also part of a project that will be launched in Việt Nam during 2023-2024, with a budget of US$477,460 funded by the Norwegian Government and $310,000 from institutes and universities.

The project aims to establish a rice seed bank, develop new rice populations, create rice genetic diversity from superior hybrid rice and wild rice as the basis to produce high-yield rice varieties that well adapt to climate change. It will be carried out in eight Vietnamese cities and provinces, namely Lào Cai, Yên Bái, Phú Thọ, Hà Nội, Phú Yên, Gia Lai, Vĩnh Long and Cần Thơ.

Attendees at the event suggested that apart from developing new rice varieties, the project should study solutions for climate change adaptation and efficient use of resources such as changing crop structure, reducing greenhouse gas emissions and conserving water resources.

They proposed the establishment of an information system to support early warning, weather forecasting and disaster prevention and control, as well as enhancing training for officials and farmers to select appropriate rice varieties and cultivation techniques suitable for different regions.

Lộc Trời targets revenue of $1 billion in 2023

Lộc Trời Group Joint Stock Company (LTG) is targeting to earn revenue of US$1billion in 2023.

At a recent annual shareholders’ meeting, the company set a goal of earning after-tax profit of at least VNĐ400 billion ($17 million).

The stock dividend for 2023 will be 30 per cent per share.

In addition, the shareholders’ meeting approved a plan to expand cultivated land to 1 million ha under the model of Lộc Trời 123.

To reach this goal, the company and its affiliate companies will continue to accelerate their projects and initiatives towards sustainable development, adapting to climate change and reducing greenhouse gas emissions.

Last year, the company made all-in efforts to overcome difficulties caused by high banking interest rates and foreign exchange rates, which made a strong impact on many agriculture companies.

Thanks to these efforts, Lộc Trời fulfilled all targets, including reaching a revenue of nearly VNĐ12 trillion ($512 million), a jump of 14 per cent.

Before tax profit was VNĐ558 billion ($23.7 million), an increase of 6 per cent year-on-year.

The agriculture segment contributed the highest portion of revenue at over VNĐ6.4 trillion ($273 million), equivalent to 55 per cent.

The Lộc Trời Agricultural Products Joint Stock Company last year signed many co-operation deals to provide paddy and rice to many partners from the EU, the US and Japan.

Lộc Trời Seed Joint Stock Company in 2022 is the leader in providing seeding to farmers. The company continued to expand their production and business in the country.

The company said that in 2022, in addition to improving the agricultural ecosystem and maintaining its leading position in the field of agricultural materials, agricultural services, processing, distribution and export of rice, the company continued to invest in improving its large-scale production towards a stable price to ensure the interest of farmers as well as making rice products that meet international quality standards.

Lộc Trời was launched in 1993 and has become among the leading agricultural companies in Việt Nam. The company’s cultivation meets standards from big markets such as Japan, the US and the EU.

E-commerce still the brightest economic sector

E-commerce will remain the fastest growing and most stable economic sector this year, according to the Việt Nam Online Business Forum 2023 in Hà Nội on Tuesday.

During the event, the Việt Nam E-commerce Association (Vecom) highlighted that global and domestic economic challenges had adversely impacted trade.

Nonetheless, maintaining the momentum from the two previous waves of growth, Vecom has predicted that e-commerce in our country will still grow at a rate of more than 25 per cent, reaching a scale of over US$20 billion.

Vecom estimated that last year, the retail e-commerce transaction scale comprised about 8.5 per cent of the total retail sales of consumer goods and services of VNĐ5,680 trillion ($240.5 billion).

Regarding retailing of goods alone, the proportion of online retail sales of goods compared to the total retail sales of goods was about 7.2 per cent last year, higher than the corresponding rate of 6.7 per cent in 2021.

According to the General Statistics Office, the national gross domestic product increased by 3.3 per cent in the first three months of this year over the same period last year.

The total retail sales of consumer goods and services were estimated at VNĐ1,505.3 trillion, up 13.9 per cent over the same period last year. If excluding the price factor, it rose by 10.3 per cent.

The two fastest-growing service sectors are accommodation and food services, up 26.0 per cent, and wholesale and retail, up 8.1 per cent.

The economy’s great difficulties from mid-2022 have extended to the first quarter and possibly until the end of this year.

Vecom assessed that e-commerce grew by over 22 per cent year-on-year in the first quarter and could still reach over 25 per cent for the whole year.

Nguyễn Ngọc Dũng, Vecom Chairman, said that in the context of businesses facing difficulties due to the economic recession and difficulties in accessing credit capital, it was urgent to provide smart financial solutions to help businesses make better use of the capital of financial institutions.

In the context that our country’s e-commerce still accounts for a small scale, about 8.5 per cent of total retail sales of consumer goods and services, efforts to bring more Vietnamese goods and products, including seafood, that could be listed on e-commerce platforms, were very important, he added.

Business on social networks about to surpass e-commerce floors

More and more businesses were choosing to do business on social networks, especially TikTok Shop, reported Vecom.

In terms of e-commerce business activities of e-commerce floors and social networks, a survey by Vecom shows that up to 65 per cent of businesses have implemented business activities on social networks.

The number of employees at enterprises who regularly use tools such as Zalo, Whatsapp, Viber, and Facebook Messenger has continuously grown.

Selling on social networks is also considered the most effective, surpassing other forms such as websites or business applications, as well as e-commerce.

A representative of Vecom said that the most prominent among social networks was the birth and strong growth of TikTok Shop.

Doing business on this platform had great appeal to many traders across the country, said the representative.

Besides, business activities on e-commerce floors continued to grow steadily. According to a survey by Vecom, 23 per cent of businesses sold products on e-commerce floors last year.

According to Data Science Joint Stock Company, the total sales of the top four e-commerce platforms, along with Tiktok Shop, amounted to about $6 billion.

Shopee and Lazada are the two largest e-commerce platforms.

Although only operating since mid-2022, Tiktok Shop has become the third largest retail e-commerce platform in Việt Nam.