BUY VIETNAM THIS MONTH

Antesco, fruit and vegetable

HuePress, lighting

Cong Thanh, essential oil

Fomexco, cashew

Hoa Long, warehouse

KC Ha Tinh, rice

King Craft Viet, handicraft

Lipo, food

Sunrise, rice

Viet Haus, rice

HEADLINES

Việt Nam retains positive economic outlook in short-term

World Bank experts has forecast Việt Nam’s economy to grow by 7.2 per cent in 2022, the highest growth rate among East Asian and Pacific economies.

According to the East Asia and the Pacific (EAP) Economic Update October 2022 released on September 27, WB experts said the growth will be supported by a strong recovery in domestic demand and continued solid performance by export-oriented manufacturing. However, it would revert to normal rates over the medium-term, with 6.7 per cent for 2023 and 6.5 per cent for 2024.

Việt Nam’s inflation rose to 3.1 per cent in July on grounds of higher transport costs, which increased by 15.2 per cent. It is projected to accelerate to 3.8 per cent in 2022 and 4.0 per cent in 2023 due to second-round effects of community price impacts.

Its public debt is estimated at 39.9 per cent of GDP in 2022 and 40.5 per cent for 2023, sustainable and well below the threshold of 60 per cent of GDP set by the National Assembly.

Its poverty is expected to decline from 3.7 per cent in 2021 to 3.3 per cent in 2022. The same goes for lower middle-income poverty, which would fall from 3.7 per cent to 3.4 per cent, before ending up at 3.1 per cent in 2023.

Its public expenditures are likely to speed up in the second half of the year, resulting in a fiscal deficit of 2.8 per cent of GDP in 2022. The deficit is projected to rise to 3.2 per cent next year as the implementation of the 2022-23 support programme picks up.

In the short term, given Việt Nam’s ongoing economic recovery and well-controlled inflation, the current accommodative monetary policy remains appropriate whereas a more supportive fiscal policy would hedge against downside risks, including heightened financial risks.

However, if inflation overshoots 4.0 per cent and core inflation hikes up, Vietnamese authorities should consider recalibrating monetary and fiscal policies.

Notably, higher financial sector risks would require intensified prudential supervision, reporting and provisioning on NPLs, and improved corporate insolvency and banking sector resolution frameworks.

In the regional scale, three factors could be a hindrance to regional growth beyond the end of 2022, which are global deceleration, rising debt and policy distortions. The growth is projected to slow to 3.2 per cent this year and accelerate to 4.6 per cent in 2023.

The consumer price index has been on the rise in recent months but remained around target ranges in several major economies. Meanwhile, inflationary pressure is building rapidly in other countries, reflecting mounting energy and food prices, as well as idiosyncratic factors.

In most EAP countries, the rise in public debt during the pandemic was driven primarily by an increase in domestic debt. At the same time, private sector debt remains high, especially household debt in China, Malaysia and Thailand.

Poverty in the region is expected to fall thanks to continued recovery from the pandemic. The pace of poverty reduction returned to pre-pandemic levels in 2022 and the number of poor is projected to reach historic lows.

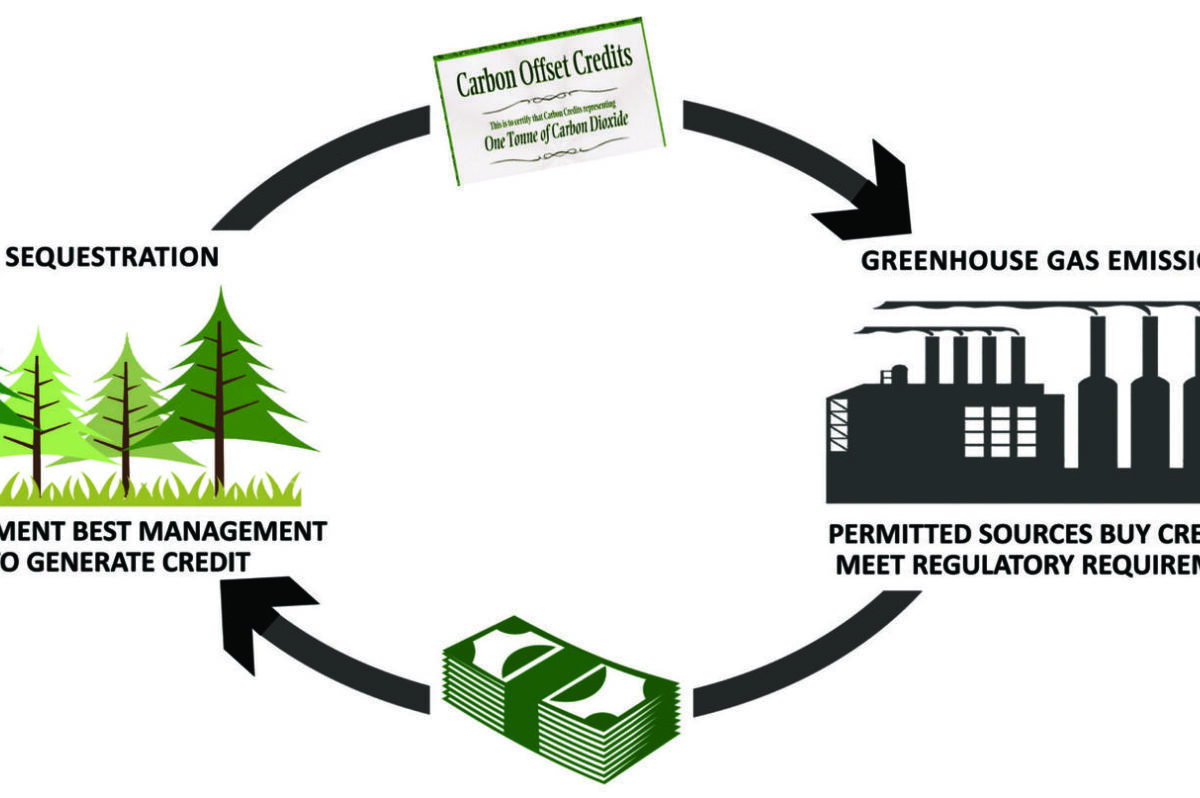

Carbon market to help achieve net zero emissions

Promoting the use of carbon pricing instruments with a focus on the development of a carbon market was important for Việt Nam to achieve its net zero emission goals, experts said.

Greenhouse gas emissions in Việt Nam increased rapidly over the past three decades in direct proportion to the economy’s growth.

According to the most recent report on greenhouse gas emissions by the Ministry of Natural Resources and Environment, total emissions would reach 928 million tonnes of CO2 equivalent by 2030 and 1.5 billion tonnes by 2050 in a moderate scenario.

Việt Nam had quite a high emission intensity per GDP unit compared to other countries in the Southeast Asian region, at about 0.35 kg CO2 per US$1.

To realise the goal of becoming a high-income country in 2045 and achieving net zero emissions by 2050 as committed at COP26, Việt Nam was facing challenges in creating a low-carbon but rapidly growing economy.

It was necessary for Việt Nam to raise all resources and apply innovative solutions, among which, carbon pricing, including carbon tax and an emissions trading market, are regarded as an effective and feasible tool.

According to Vietnam Initiative for Energy Transition (VIETSE), currently, Việt Nam indirectly imposes a tax on carbon through the environmental protection tax on fossil fuel producers and importers. However, this tax rate did not really reflect the nature of carbon pricing.

International experience showed that carbon tax and an emissions trading market could be flexibly applied in tandem to optimise emissions reductions. However, the emissions trading market was becoming more and more popular because it allowed businesses to be flexible and proactive in choosing measures to comply with emissions quotas and achieve cost-effectiveness.

The carbon market was first mentioned in the Prime Minister’s Decision 1775/QĐ-TTg in 2012, then the Party’s Resolution 24-NQ/TW in 2013 and Resolution 50-NQ/CP in 2021.

Accordingly, the Vietnamese Government recognised the development of a carbon market as a must-do to respond to climate change and protect the environment.

Wolfgang Mostert, an expert in energy and climate policies, said that carbon pricing was a policy toward efficiency to achieve emissions reduction goals at the lowest cost.

The carbon market played an important role in the process, however, it would take time and require a large investment to develop and operate this market, he said.

In the current context of deepening economic integration, many countries were striving to reduce greenhouse gas emissions which became a mandatory requirement for enterprises.

Emissions reduction was not only to reduce harm to the environment but also to move towards sustainable development and meet the green standards of importing markets.

Việt Nam’s major export markets, including the EU and the US, were preparing to pilot the implementation of the Carbon Border Adjustment Mechanism (CBAM). Accordingly, technical barriers and regulations related to emissions reduction would be erected to force enterprises to follow and a carbon tax would be imposed if enterprises did not meet the requirements.

The pilot implementation was set to start in 2023 for sectors including cement, aluminium, power, steel and iron production. CBAM would officially be applied from 2026. The range of industries which must comply with CBAM would continue to expand in the future, posing significant challenges for Vietnamese export goods.

However, the operation of a carbon market would also create an advantage for Việt Nam’s domestically produced goods to increase competitiveness.

Trương An Hà, an export from VIETSE, said that the development and operation of a domestic carbon market would help Việt Nam to take opportunities arising from carbon emissions efficiently, increase adaptability to international carbon pricing mechanisms and enhance the competitiveness of Vietnamese products.

Moreover, a carbon market was also a mechanism to create resources for the development and application of low-emission technologies toward a carbon-neutral economy, she said.

Experts said that it was necessary to develop a clear sanction mechanism for entities which did not comply with their given quotas. Emissions quotas should be set in a harmonious way between emission reduction targets and economic development goals and encourage enterprises to apply emission reduction technologies.

Emissions trading should be piloted first in sectors which were easy to measure such as electricity, industry and buildings before expanding to others, together with a clear mechanism for using revenue from the carbon market to ensure efficiency in promoting low-emission technologies.

FROM THE BEGINNING OF THIS YEAR

Sweden exports to Vietnam

| Products | 8M/2021 | 8M/2022 | Change (%) |

|---|---|---|---|

| All products (USD) | 227,233,551 | 226,977,112 | -0.1 |

| Other petroleum products | 1,044,923 | 1,648,062 | 57.7 |

| Chemical products | 13,472,565 | 8,839,800 | -34.4 |

| Pharmaceutical products | 41,583,158 | 53,168,363 | 27.9 |

| Plastic materials | 3,035,100 | 2,918,147 | -3.9 |

| Plastic products | 6,716,248 | 2,822,079 | -58 |

| Wood and articles of wood | 8,158,011 | 4,823,646 | -40.9 |

| Paper products | 23,026,300 | 17,304,177 | -24.9 |

| Iron or steel | 10,283,680 | 12,485,823 | 21.4 |

| Articles of iron or steel | 4,442,911 | 3,408,012 | -23.3 |

| Computers, electrical products, part thereof | 1,769,164 | 3,275,795 | 85.2 |

| Telephone sets, parts thereof | 66,028 | 140,847 | 113.3 |

| Other machinery, equipment, tools and spare parts | 79,733,362 | 73,005,519 | -8.4 |

Sweden imports from Vietnam

| Products | 8M/2021 | 8M/2022 | Change (%) |

|---|---|---|---|

| All products (USD) | 717,467,341 | 894,067,985 | 24.6 |

| Fish and crustaceans, molluscs and other aquatic invertebrates | 11,062,854 | 16,311,877 | 47.4 |

| Plastic products | 12,241,335 | 12,666,396 | 3.5 |

| Rubber | 420,109 | 520,545 | 23.9 |

| Bags, purses, suitcases, hats, umbrellas | 18,512,818 | 22,627,448 | 22.2 |

| Products of rattan, bamboo, sedge and carpet | 8,329,945 | 7,591,364 | -8.9 |

| Wood and articles of wood | 20,283,141 | 21,177,380 | 4.4 |

| Textiles and garments | 55,839,933 | 89,645,069 | 60.5 |

| Footwears, parts of such articles | 55,586,967 | 74,429,128 | 33.9 |

| Materials for textiles and garments, and footwares | 8,431,271 | 5,438,851 | -35.5 |

| Ceramic products | 2,533,730 | 1,518,448 | -40.1 |

| Articles of iron or steel | 24,642,578 | 85,301,923 | 246.2 |

| Other metals and products | 1,565,538 | 949,891 | -39.3 |

| Computers, electrical products, part thereof | 41,425,488 | 53,438,115 | 29 |

| Telephone sets, parts thereof | 331,212,626 | 345,368,923 | 4.3 |

| Machinery, mechanical appliances, equipment, parts thereof | 41,303,033 | 50,039,112 | 21.2 |

| Toys, sports equipment and parts | 6,372,287 | 8,359,896 | 31.2 |

Denmark exports to Vietnam

| Products | 8M/2021 | 8M/2022 | Change (%) |

|---|---|---|---|

| All products (USD) | 161,733,621 | 149,662,293 | -7.5 |

| Fish and crustaceans, molluscs and other aquatic invertebrates | 13,037,040 | 13,413,597 | 2.9 |

| Milk and dairy products | 1,493,205 | 3,483,306 | 133.3 |

| Chemical products | 20,589,173 | 19,400,256 | -5.8 |

| Pharmaceutical products | 17,315,421 | 12,926,132 | -25.3 |

| Plastic products | 4,769,776 | 5,093,206 | 6.8 |

| Materials for textiles and garments, and footwares | 10,209,931 | 150,946 | -98.5 |

| Iron or steel | 67,576 | 84,898 | 25.6 |

| Articles of iron or steel | 5,119,633 | 5,074,738 | -0.9 |

| Computers, electrical products, part thereof | 3,648,228 | 4,542,458 | 24.5 |

| Other machinery, equipment. tools and spare parts | 38,684,052 | 36,578,597 | -5.4 |

| Electric wires and cables | 1,936,797 | 2,420,774 | 25 |

Denmark imports from Vietnam

| Products | 8M/2021 | 8M/2022 | Change (%) |

|---|---|---|---|

| All products (USD) | 234,767,279 | 353,279,211 | 50.5 |

| Fish and crustaceans, molluscs and other aquatic invertebrates | 33,204,736 | 56,726,822 | 70.8 |

| Coffee | 1,131,477 | 1,394,840 | 23.3 |

| Plastic products | 14,868,687 | 14,028,489 | -5.7 |

| Bags, purses, suitcases, hats, umbrellas | 4,705,844 | 8,846,035 | 88 |

| Products of rattan, bamboo, sedge and carpet | 6,124,368 | 5,892,749 | -3.8 |

| Wood and articles of wood | 30,928,244 | 31,983,799 | 3.4 |

| Textiles and garments | 35,327,943 | 62,140,302 | 75.9 |

| Footwears, parts of such articles | 7,616,775 | 21,543,793 | 182.8 |

| Ceramic products | 4,674,681 | 3,672,691 | -21.4 |

| Articles of iron or steel | 9,635,893 | 10,221,498 | 6.1 |

| Other machinery, equipment, tools and spare parts | 15,742,453 | 24,159,283 | 53.5 |

| Electric wires and cables | 8,904,744 | 11,796,752 | 32.5 |

| Transport vehicles and spare parts | 5,510,343 | 32,170,737 | 483.8 |

| Furniture products from materials other than wood | 20,440,156 | 22,200,729 | 8.6 |

| Toys, sports equipment and parts | 5,604,492 | 8,614,931 | 53.7 |

Norway exports to Vietnam

| Products | 8M/2021 | 8M/2022 | Change (%) |

|---|---|---|---|

| All products (USD) | 235,534,433 | 265,400,946 | 12.7 |

| Fish and crustaceans, molluscs and other aquatic invertebrates | 156,768,528 | 165,775,101 | 5.7 |

| Chemical products | 3,510,839 | 2,956,422 | -15.8 |

| Fertilizers | 7,534,094 | 16,995,625 | 125.6 |

| Articles of iron or steel | 3,266,166 | 5,030,601 | 54 |

| Other machinery, equipment. tools and spare parts | 28,353,626 | 43,636,799 | 53.9 |

Norway imports from Vietnam

| Products | 8M/2021 | 8M/2022 | Change (%) |

|---|---|---|---|

| All products (USD) | 90,363,128 | 94,113,974 | 4.2 |

| Fish and crustaceans, molluscs and other aquatic invertebrates | 5,884,506 | 7,425,678 | 26.2 |

| Fruits and vegetables | 2,035,502 | 1,665,981 | -18.2 |

| Cashew nuts | 3,914,377 | 4,559,706 | 16.5 |

| Plastic products | 2,926,760 | 3,362,638 | 14.9 |

| Bags, purses, suitcases, hats, umbrellas | 1,834,192 | 3,893,832 | 112.3 |

| Wood and articles of wood | 2,005,435 | 2,177,791 | 8.6 |

| Textiles and garments | 11,768,073 | 14,356,540 | 22 |

| Footwears, parts of such articles | 16,812,301 | 22,703,218 | 35 |

| Articles of iron or steel | 4,344,861 | 449,363 | -89.7 |

| Cameras, camcorders and components | 3,575,820 | 5,003,724 | 39.9 |

| Other machinery, equipment, tools and spare parts | 4,704,430 | 2,391,045 | -49.2 |

| Transport vehicles and spare parts | 4,383,562 | 2,398,196 | -45.3 |

| Furniture products from materials other than wood | 2,893,559 | 2,793,051 | -3.5 |

OTHER NEWS

Dim outlook for domestic auto component industry

Vietnamese automotive component industry has a dim outlook for growth as it lags behind those in many other regional countries, according to the Ministry of Industry and Trade (MoIT).

Notably, the number of domestic suppliers qualified to participate in automobile manufacturing and assembling in Việt Nam pales compared to that in Thailand.

The former has fewer than 100 tier-1 suppliers, whereas the latter has nearly 700. The contrast becomes starker in tier-2 and tier-3, with fewer than 150 against 1,700.

The country has also failed to achieve high coverage of domestically-manufactured autos as the ratio of the cars to total autos stayed at just 7-10 per cent, given the target of 30-40 per cent by 2020.

“The actual ratio fell far short of targets and was dwarfed by the figures in Thailand, Indonesia and Malaysia,” the ministry said.

It is worth noting that domestic suppliers produce mostly labour-intensive and low-tech components, including car seats and rubber tires. Such a low value-added production has left domestic components with just a tiny piece of the pie (2.7 per cent).

The lion’s share of the pie fell to imported components, predominantly from Japan, China, Korea and Thailand. Specifically, Việt Nam imported around US$2 billion of parts per year between 2010 and 2016.

The MoIT held that the domestic component industry’s disadvantage could be caused by outdated production plants and low machinery investments. Without upgraded production lines, domestic suppliers would end up being no match for foreign rivals.

The MoIT suggested more public money be spent to establish three supportive centres in the Northern, Central, and Southern regions. The three centres will be tasked with supporting the growth of domestic suppliers.

“These centres will act as technical centres for testing, quality measurement, inspection, quality certification, consultation and technology transfer, to support domestic suppliers,” the ministry said.

It also called for preferential bank loans to domestic suppliers to boost machinery investments in the industry. The loans are recommended to be easily accessible until 2025.

Additionally, the MoIT called for favourable policies to draw more foreign investment into the domestic component industry to nurture its development. However, not all investments should be permitted, only those for home-market-oriented and ASEAN-market-oriented components.

The MoIT called for large-scale production plants in automotive materials, such as steel, to allow domestic suppliers to be less dependent on imported input, thereby incurring fewer costs.

Foreign investment disbursement hits record high in nine months

Disbursement of foreign direct investment (FDI) in the first nine months of this year reached US$15.4 billion, up 16.2 per cent year-on-year and marking a record high, a report from the Foreign Investment Department (FIA) has shown.

This positive figures showed that foreign-invested enterprises have been constantly recovering and expanding their production and business activities in Việt Nam, FIA said in its report.

However, foreign investment inflows into Việt Nam saw a yearly decline of 15.3 per cent to over $18.7 billion in the nine-month period.

Up to 1,355 new foreign-invested projects were licensed during the period with a total registered capital of $7.12 billion, up 11.8 per cent in the number of projects but down 43 per cent in terms of the level of capital.

The agency attributed the decline in newly-registered capital to difficulties encountered by foreign investors in coming to Việt Nam to explore investment opportunities and fulfilling investment registration procedures in the last months of 2021 due to the State policies on controlling the COVID-19 pandemic. That have affected the number of new projects granted licences in the first months of 2022.

Also, the global market has been facing many fluctuations due to the influence of the geopolitical conflict in Europe, high inflation pressure, and supply chain disruptions, which have been negatively affecting the outflow of foreign investment from major economies, especially investment partners of Việt Nam.

The FIA also named a lack of large-scale projects worth over $100 million in the first months of 2022 compared to that of 2021 as one of the major reasons. These projects including Long An 1 and 2 LNG power plants worth a combined over $3.2 billion and Ô Môn 2 thermal power plant valued at above $1.3 billion contributed 62.3 per cent of the total capital pledged in the nine months of 2021.

Meanwhile, the first nine months of this year saw few foreign-invested projects with a scale of over $100 million, and these projects accounted for only 37.2 per cent of the period’s total registered investment capital.

In another bright spot, capital added by foreign businesses to 769 operating projects in the country surged 30 per cent to $8.3 billion. That has demonstrated their great confidence in Việt Nam’s economy and its investment climate, according to the agency.

Phan Hữu Thắng, director of the Foreign Investment Research Centre, agreed. He told baodautu.vn that the success of the large-scale foreign enterprises in Việt Nam would help attract other ones to the country.

At the same time, foreign investor capital contributions and share purchases also recorded a yearly hike of 2 per cent to $3.28 billion.

The processing and manufacturing sector lured the lion’s share of FDI with over $12.1 billion, accounting for 65 per cent of the country’s total capital.

Real estate came next with $3.5 billion or 18.7 per cent. Science and technology and wholesale and retail were the runners-up with $677 million and $620 million, respectively.

Singapore remained Việt Nam’s leading source of foreign investment with above $4.75 billion, making up 25.3 per cent of the total FDI registered in the country.

South Korea followed with nearly $3.8 billion or 20.3 per cent, and Japan with $1.9 billion or 10.2 per cent.

The country’s other major foreign investors were mainland China, Denmark and Hong Kong.

A survey conducted by the Ministry of Planning and Investment and the Vietnam Business Forum Alliance (VBF) in September 2022 showed that over 90 per cent of FDI enterprises achieved medium and high business efficiency and financial status.

Most surveyed businesses expressed their optimism and confidence in Việt Nam and committed to continue to expand investment in the country. Of them, 66 per cent said they planned to enlarge their investment scale in 2023.

According to the FIA director Đỗ Nhất Hoàng, Việt Nam expected good results in FDI attraction in 2022 and following years when countries have been gradually opening up their economies and adapting to the new normal conditions.

In addition, many international corporations and businesses have been looking for investment locations to diversify their supply chains and Việt Nam has been evaluated by international organisations as an attractive and safe investment destination.

In the next two or three years, technology corporations still prioritise Việt Nam as an investment or expansion location, especially in manufacturing and processing, technology pharmaceuticals and energy, Hoàng told baodautu.vn.

In order to effectively catch up with this investment wave, Minister of Planning and Investment Nguyễn Chí Dũng emphasised the importance of preparing an adequate source of land, perfecting infrastructure and bettering the supply of energy and skilled labour.

Improving capacities of domestic enterprises so that they could participate in value chains while drawing up incentives and investment support packages to negotiate with strategic foreign investors should also be included.

In the long term, it would also be necessary to improve the business investment environment and speed up administrative reform, Dũng said.

European enterprises optimistic about Viet Nam’s economy

European firms have shown their optimism about the Vietnamese economy, which is recovering strongly after the COVID-19 pandemic, Vice Chairman of the European Chamber of Commerce in Việt Nam (EuroCham) Nguyễn Hải Minh has said.

According to Minh, despite the global supply disruptions induced by the pandemic, Việt Nam still exported more than US$35.1 billion worth of goods to the EU in 2020 and over $40 billion last year.

Meanwhile, the Southeast Asian nation imported $14.6 billion and $16.7 billion worth of commodities from the bloc in the two years, respectively.

In the first eight months of this year, Việt Nam’s exports to the EU were valued at $31.9 billion, up 23.6 per cent, resulting in a trade surplus of up to $21.6 billion, a rise of 46.4 per cent.

The figures reflected positive impacts of the EU-Việt Nam Free Trade Agreement (EVFTA), he noted.

However, Minh said, European enterprises in Việt Nam said they benefited more from the EVFTA as the country’s export to the EU mainly came from FDI firms.

EuroCham member businesses and even those that have yet to invest in Việt Nam expressed their hope that the EU-Việt Nam Investment Protection Agreement (EVIPA) would soon be approved and take effect, paving the way for European firms to expand investment in the Southeast Asian nation.

Minh also cited the Business Climate Index (BCI) released by EuroCham showing that European business stakeholders’ confidence in Việt Nam’s investment environment declined slightly in the second quarter of this year to 68.8 per cent due to external factors.

Up to 60 per cent of respondents predicted that the Vietnamese economy would stabilise or improve in the third quarter of 2022, 45 per cent were significantly or moderately satisfied with Việt Nam’s efforts to attract and retain foreign direct investment (FDI), and 76 per cent expected to increase FDI in the country before the end of the third quarter.

55 per cent of respondents said Việt Nam improved its FDI attraction and retention capabilities since the first quarter.

Regarding the link between green growth and FDI, nearly 90 per cent of respondents said that Việt Nam should increase green economy development to attract more foreign investment.

Minh said apart from the above advantages, Việt Nam’s improved administrative procedures also helped to attract foreign investors, including those from the EU.

He also noted that many EU enterprises were still concerned about specialised inspections in Việt Nam, which remain overlapping.