BUY VIETNAM THIS MONTH

HEADLINES

Promoting Strategic Cooperation between Vietnam and Sweden in Green, Digital, and Sustainable Development

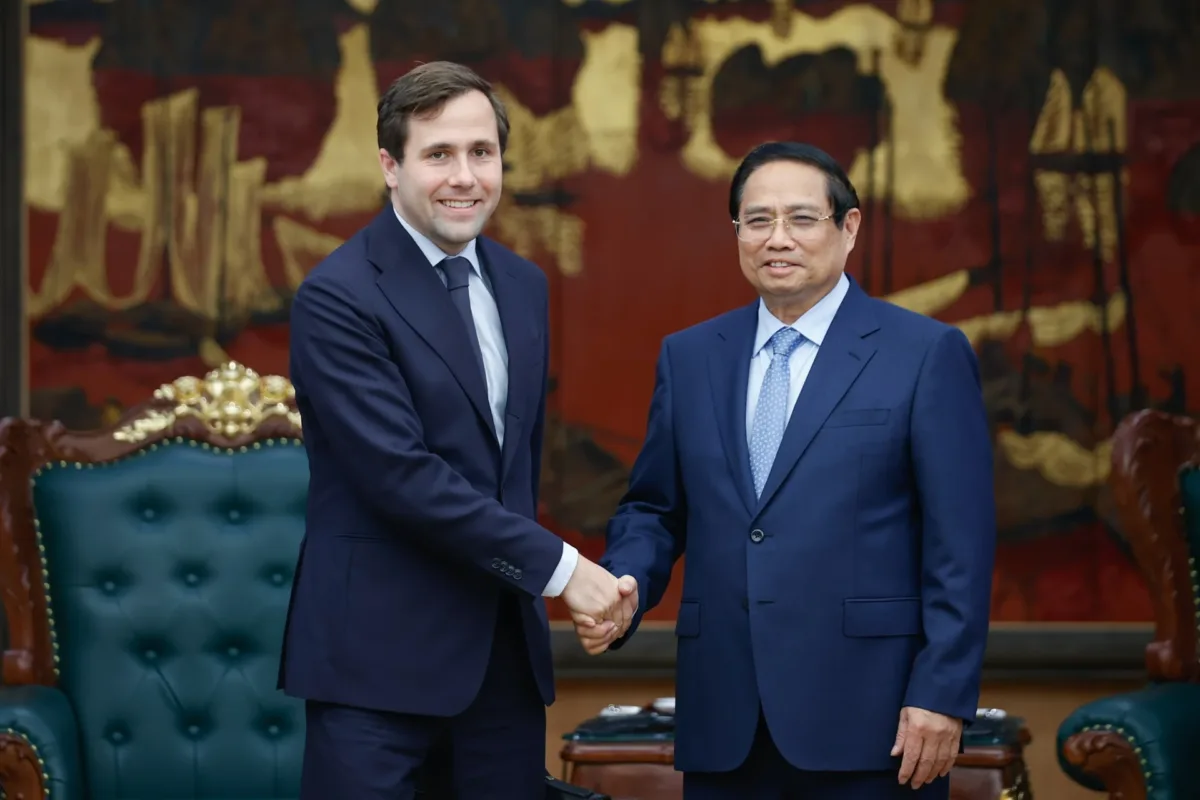

From May 12 to 13, 2025, Swedish Minister for International Development Cooperation and Foreign Trade, Mr. Benjamin Dousa, paid his first official visit to Vietnam in his ministerial role. The visit not only reaffirmed the traditional friendship of over 55 years between the two countries, but also paved the way for new directions in strategic cooperation, as Vietnam emerges as a key hub for production and innovation in the Asia-Pacific region.

Vietnam – Sweden: Strong Friendship and Substantive Cooperation

During his meeting with Minister Benjamin Dousa, Prime Minister Pham Minh Chinh emphasized the significant milestones in bilateral relations—ranging from Sweden being the first Western nation to establish diplomatic relations with Vietnam, to its provision of over USD 3 billion in non-refundable aid, which supported the construction of iconic medical and industrial projects such as the Bai Bang Paper Mill, the National Children’s Hospital, and Uong Bi Hospital.

The Prime Minister underscored the need for enhanced collaboration across strategic areas such as green transition, digital transformation, science and technology, education, and healthcare—particularly in key infrastructure investments including seaports, airports, railways, and renewable energy—against the backdrop of a volatile global trade environment.

He affirmed Vietnam’s readiness to serve as a gateway for Swedish goods to enter the ASEAN market, while expressing hope that Sweden would become a bridge for Vietnamese products to access the Nordic region—characterized by high living standards, stringent sustainability criteria, and growing demand for green, organic, and responsible products.

Green and Digital Transformation: New Pillars of Cooperation Between Two Leading Economies

Speaking at the Vietnam–Sweden Investment Dialogue on Infrastructure and Green Transition, Minister Dousa emphasized: “Vietnam is not only a place for manufacturing, but is increasingly becoming a place for research and development.” He noted that this opens a new era of cooperation that goes beyond traditional trade, toward co-creation and co-innovation between enterprises of both countries.

Green transition and circular economy were central themes of the visit. Minister Dousa praised Vietnam’s commitment to carbon neutrality and stated that Sweden is ready to share its advanced solutions in renewable energy, sustainable packaging, wastewater treatment and recycling, as well as promote cooperation in artificial intelligence, semiconductors, and smart digital infrastructure.

Sweden: Recognizing Vietnam as a Strategic Partner in the Global Value Chain

With impressive GDP growth, a skilled young workforce, and an economy climbing higher in the global value chain, Vietnam is increasingly viewed by the Swedish business community as one of the most promising investment destinations in Asia.

Currently, around 70 Swedish companies operate in Vietnam, including major names such as Ericsson, ABB, AstraZeneca, Tetra Pak, and Getinge. Minister Dousa expressed his hope that this number would double in the coming years, particularly in sectors such as digital healthcare, life sciences, industrial equipment, smart mobility, and innovation.

“I work day and night to bring more Swedish businesses to Vietnam,” he told the press, emphasizing that “Free trade and openness are the keys to innovation and sustainable development.”

Commitment to Promoting EVIPA and Lifting the IUU Yellow Card

In high-level meetings with Vietnamese leaders, Minister Dousa pledged to advocate for the swift ratification of the EU–Vietnam Investment Protection Agreement (EVIPA) by EU member states, in order to provide a solid legal framework for long-term investment flows between the two sides.

He also confirmed Sweden’s willingness to coordinate with relevant European Commission bodies to push for the lifting of the “IUU yellow card” on Vietnam’s seafood exports, supporting the sector’s reaccess to the EU—one of Vietnam’s most important and sustainable export markets.

Strengthening Cooperation in Healthcare and Innovation

As part of the visit, Minister Dousa toured the Vietnam National Children’s Hospital, met with hospital leadership, and discussed potential initiatives in pediatric care, digital healthcare, diagnostic technology, and medical research.

He also delivered the opening address at the Vietnam–Sweden Healthcare Cooperation Conference, attended by leading companies in life sciences and medical devices, including AstraZeneca, Elekta, Getinge, and Mölnlycke.

A New Chapter of Cooperation Between Two Forward-Thinking Nations

Minister Benjamin Dousa’s visit to Vietnam not only continued a legacy of long-standing friendship, but also ushered in a new phase of deepened, practical, and strategic cooperation—particularly as both nations strive toward shared goals of green, equitable, and sustainable development.

In this shared vision, Vietnam can become a central partner in Swedish companies’ expansion strategies in Asia, while Sweden remains a source of inspiration in innovation, technology, and a development model that harmonizes growth with social responsibility.

OTHER NEWS

Sweden exports to Vietnam

| Products | 4M/2024 | 4M/2025 | Change (%) |

|---|---|---|---|

| All products (USD) | 353,742,811 | 403,925,950 | 14.2 |

| Fish and crustaceans, molluscs and other aquatic invertebrates | 6,145,098 | 11,562,775 | 88.2 |

| Plastic products | 6,324,588 | 6,464,133 | 2.2 |

| Rubber | 159,970 | 301,795 | 88.7 |

| Bags, purses, suitcases, hats, umbrellas | 7,695,731 | 9,332,825 | 21.3 |

| Products of rattan, bamboo, sedge and carpet | 3,010,778 | 2,719,850 | -9.7 |

| Wood and articles of wood | 8,793,303 | 10,959,066 | 24.6 |

| Textiles and garments | 22,513,170 | 36,732,844 | 63.2 |

| Footwears, parts of such articles | 14,460,362 | 24,649,061 | 70.5 |

| Materials for textiles and garments, and footwares | 1,376,034 | 1,516,331 | 10.2 |

| Ceramic products | 1,521,412 | 530,874 | -65.1 |

| Articles of iron or steel | 3,072,091 | 30,612,154 | 896.5 |

| Other metals and products | 172,952 | 878,969 | 408.2 |

| Computers, electrical products, part thereof | 32,604,443 | 49,519,111 | 51.9 |

| Telephone sets, parts thereof | 140,417,731 | 122,056,741 | -13.1 |

| Machinery, mechanical appliances, equipment, parts thereof | 33,953,698 | 41,087,208 | 21.0 |

| Toys, sports equipment and parts | 3,452,157 | 4,161,389 | 20.5 |

Sweden imports from Vietnam

| Products | 4M/2024 | 4M/2025 | Change (%) |

|---|---|---|---|

| All products (USD) | 113,662,696 | 176,514,408 | 55.3 |

| Other petroleum products | 1,089,212 | 1,390,433 | 27.7 |

| Chemical products | 3,112,776 | 4,535,719 | 45.7 |

| Pharmaceutical products | 32,470,432 | 61,480,516 | 89.3 |

| Plastic materials | 650,222 | 1,023,062 | 57.3 |

| Plastic products | 2,373,655 | 2,308,956 | -2.7 |

| Wood and articles of wood | 1,734,406 | 1,911,230 | 10.2 |

| Paper products | 10,258,967 | 18,069,102 | 76.1 |

| Iron or steel | 2,739,187 | 5,659,821 | 106.6 |

| Articles of iron or steel | 3,546,475 | 3,785,197 | 6.7 |

| Computers, electrical products, part thereof | 2,731,392 | 2,261,296 | -17.2 |

| Telephone sets, parts thereof | - | - | - |

| Other machinery, equipment, tools and spare parts | 39,456,563 | 46,015,182 | 16.6 |

Denmark exports to Vietnam

| Products | 4M/2024 | 4M/2025 | Tăng/giảm (%) |

|---|---|---|---|

| All products (USD) | 137,226,310 | 139,835,040 | 1.9 |

| Fish and crustaceans, molluscs and other aquatic invertebrates | 14,586,669 | 13,413,706 | -8.0 |

| Coffee | 1,819,998 | 4,742,432 | 160.6 |

| Plastic products | 8,175,307 | 8,569,802 | 4.8 |

| Bags, purses, suitcases, hats, umbrellas | 5,194,238 | 3,505,083 | -32.5 |

| Products of rattan, bamboo, sedge and carpet | 2,298,794 | 2,470,934 | 7.5 |

| Wood and articles of wood | 10,574,930 | 11,167,763 | 5.6 |

| Textiles and garments | 13,424,502 | 21,231,477 | 58.2 |

| Footwears, parts of such articles | 7,755,002 | 9,536,528 | 23.0 |

| Ceramic products | 2,446,789 | 2,635,807 | 7.7 |

| Articles of iron or steel | 13,772,280 | 9,308,631 | -32.4 |

| Other machinery, equipment, tools and spare parts | 6,931,289 | 10,683,711 | 54.1 |

| Electric wires and cables | 11,431,600 | 9,606,706 | -16.0 |

| Transport vehicles and spare parts | 1,595,971 | 2,490,305 | 56.0 |

| Furniture products from materials other than wood | 11,738,718 | 8,374,848 | -28.7 |

| Toys, sports equipment and parts | 667,937 | 1,509,628 | 126.0 |

Denmark imports from Vietnam

| Products | 4M/2024 | 4M/2025 | Tăng/giảm (%) |

|---|---|---|---|

| All products (USD) | 64,982,979 | 77,110,477 | 18.7 |

| Fish and crustaceans, molluscs and other aquatic invertebrates | 3,240,001 | 8,850,358 | 173.2 |

| Milk and dairy products | 1,287,136 | 2,138,814 | 66.2 |

| Chemical products | 7,815,423 | 5,997,693 | -23.3 |

| Pharmaceutical products | 6,106,376 | 7,086,576 | 16.1 |

| Plastic products | 2,816,244 | 4,584,365 | 62.8 |

| Materials for textiles and garments, and footwares | 67,545 | 97,009 | 43.6 |

| Iron or steel | 55,433 | 42,904 | -22.6 |

| Articles of iron or steel | 2,452,603 | 4,781,866 | 95.0 |

| Computers, electrical products, part thereof | 2,713,374 | 1,387,313 | -48.9 |

| Other machinery, equipment. tools and spare parts | 18,296,258 | 15,951,488 | -12.8 |

| Electric wires and cables | 852,594 | 764,597 | -10.3 |

Norway exports to Vietnam

| Products | 4M/2024 | 4M/2025 | Tăng/giảm (%) |

|---|---|---|---|

| All products (USD) | 34,791,180 | 49,708,614 | 42.9 |

| Fish and crustaceans, molluscs and other aquatic invertebrates | 3,077,824 | 3,666,624 | 19.1 |

| Fruits and vegetables | 1,259,029 | 1,051,597 | -16.5 |

| Cashew nuts | 2,353,237 | 3,230,174 | 37.3 |

| Plastic products | 1,167,402 | 870,797 | -25.4 |

| Bags, purses, suitcases, hats, umbrellas | 1,353,463 | 3,278,922 | 142.3 |

| Wood and articles of wood | 781,124 | 1,114,506 | 42.7 |

| Textiles and garments | 2,645,490 | 3,399,874 | 28.5 |

| Footwears, parts of such articles | 5,733,616 | 6,987,753 | 21.9 |

| Articles of iron or steel | 733,477 | 657,944 | -10.3 |

| Cameras, camcorders and components | 941,181 | 3,286,851 | 249.2 |

| Other machinery, equipment, tools and spare parts | 3,185,779 | 3,433,520 | 7.8 |

| Transport vehicles and spare parts | 953,238 | 4,502,028 | 372.3 |

| Furniture products from materials other than wood | 1,374,684 | 986,820 | -28.2 |

Norway imports from Vietnam

| Products | 4M/2024 | 4M/2025 | Tăng/giảm (%) |

|---|---|---|---|

| All products (USD) | 146,299,851 | 200,734,363 | 37.2 |

| Fish and crustaceans, molluscs and other aquatic invertebrates | 97,729,696 | 113,847,627 | 16.5 |

| Chemical products | 1,693,055 | 1,789,519 | 5.7 |

| Fertilizers | 9,250,744 | 15,479,872 | 67.3 |

| Articles of iron or steel | 1,998,715 | 1,791,982 | -10.3 |

| Other machinery, equipment. tools and spare parts | 16,632,127 | 48,559,393 | 192.0 |

OTHER NEWS

Bắc Ninh aims to become Việt Nam’s leading semiconductor industrial hub

The People’s Committee of Bắc Ninh Province has set an ambitious goal to transform the province into a leading semiconductor industrial hub in northern Việt Nam during the 2025–2030 period, and beyond.

Bắc Ninh will focus on the deep development of the semiconductor industry, establish a centralised information technology zone, and train a highly skilled workforce, including engineers and microchip specialists.

The province will also step up efforts to attract foreign investment, particularly from major corporations in the semiconductor sector.

Between 2030 and 2045, Bắc Ninh, as outlined under Plan No. 323/KH-UBND, aims to become a regional centre for microchip and semiconductor production.

It plans to build chip manufacturing plants, master several core technologies, and integrate deeply into the global semiconductor supply chain, exporting products under the ‘Made in Việt Nam’ brand.

By 2030, it wants to have trained at least 30,050 workers in the semiconductor industry. Of the total, 1.8 per cent will be university graduates and 43.3 per cent college-level technicians. The remainder will undergo intermediate training or upskilling and conversion programmes.

A dedicated industrial cluster for semiconductor support industries will be established to reduce dependency on imported components and materials.

Bắc Ninh also aims to attract three to five major technology corporations to invest in manufacturing plants and R&D centres in the province, while encouraging existing investors to expand operations. The vision is to establish Bắc Ninh as a top production and export centre for microchips in the region.

To realise this vision, the provincial People’s Committee has tasked the Department of Finance to coordinate with relevant agencies to complete mechanisms and policies for semiconductor development.

Proposed policies include corporate income tax exemptions for semiconductor investors, import tax incentives for high-tech components and equipment used in research and production, and a ‘60 per cent green lane’ policy to fast-track administrative procedures for semiconductor-related projects.

Additional incentives are being considered, such as low-interest credit support for semiconductor start-ups, the building of a semiconductor innovation support fund for domestic firms and financial aid for land rental costs in local industrial zones for semiconductor manufacturers.

The province will ensure the provision of essential infrastructure and internationally standardised internet services to support high-tech production. It will also explore the establishment of a research and development centre for microchips and semiconductor manufacturing.

In the first four months of this year, Bắc Ninh has emerged as the top performer in attracting foreign direct investment (FDI) nationwide. It secured over US$1.91 billion, 2.2 times higher than the same period last year. — BIZHUB/VNS

Việt Nam’s coffee exports reach $4.2 billion in first five months

As of mid-May 2025, Việt Nam exported over 736,000 tonnes of coffee, earning US$4.2 billion, according to the Department of Customs.

While export volume declined by 5.5 per cent year-on-year, export value surged by 56 per cent thanks to a sharp rise in average prices.

Domestically, coffee prices in the Central Highlands reversed course on May 24, falling by VNĐ2,500 ($0.096) – VNĐ3,300 per kilogramme. Prices stood at VNĐ122,500 per kilogramme in Đắk Nông, Đắk Lắk and Gia Lai, and VNĐ122,000 per kilogramme in Lâm Đồng.

Agricultural experts forecast that domestic prices may continue to drop to around VNĐ120,000 per kilogramme due to the downward trend in global markets. Key drivers behind recent price hikes, such as weather concerns and trade tensions, are showing signs of easing.

In addition, increased investment in cultivation and replanting over the past two years is expected to boost supply in the near future. — VNS

Clear exit strategies key to unlocking private capital

As Việt Nam positions itself as a leading destination for private capital in Southeast Asia, investors and founders now all care about one thing: a clear and reliable exit strategy.

Industry experts said that while Việt Nam’s start-up scene is buzzing and its economy remains one of the most dynamic in the region, private capital will only continue to flow if investors are assured of viable returns.

In other words, it’s not enough to enter the market with enthusiasm – there must be a way out.

According to Michael H. Nguyễn, deputy CEO of Masan Group, investors don’t just look at the entry point, they care even more about how and when they can exit.

Over the past 17 years Masan has raised over US$2 billion from a blend of strategic and financial investors, Nguyễn said during a recent panel on pathways to exits in Việt Nam.

He attributed this achievement to Masan’s unwavering commitment to building trust with investors, offering multiple exit routes including IPOs and trade sales.

“What makes us proud is that most of those investors have come back to invest again,” he said.

“That shows they believe they can generate returns – which requires a clear path to exit. It’s a credible path that any investor should seriously consider when looking at Việt Nam.”

Nguyễn said Masan offered three main exit options for investors: secondary sales, strategic sales (like Singha’s stake in KKR), and IPOs, such as Masan Group’s listing. “While IPOs remain a viable option,the market is more challenging now.”

This view is shared by Lê Hoài Vy, general partner at Do Venture and chairperson of the Vietnam Private Capital Agency (VPCA), a strong voice for enhancing Việt Nam’s investment landscape.

She believes Việt Nam is at a pivotal moment. For the first time, the government is demonstrating a strong and clear will to support innovation and startup growth.

However, she warned that a lack of high-profile exit success stories in recent years held the ecosystem back.

“There’s a great deal of investor interest, but without successful exits, especially in the last three to four years, reinvestment becomes harder,” Vy said.

“We need to create more exit stories like we once had with Thế Giới Di Động (Mobile World). That builds momentum, credibility and trust in the market.”

The Vietnam Innovation and Capital Report 2025, released last month by the Việt Nam Private Capital Agency (VPCA), National Innovation Centre (NIC), and Boston Consulting Group (BCG), said in 2024 the country drew nearly $2.3 billion across 141 foreign-funded innovation deals.

Although total investment fell by 17 per cent compared to the previous year, this was modest relative to the 35 per cent global decline, reflecting Việt Nam’s resilience and growing appeal.

The report pointed out key growth drivers such as strong GDP growth at 7.1 per cent in 2024 (higher than most Asian economies), rising foreign investment, an expanding middle class expected to reach 46 per cent of the population by 2030, and a digital economy aiming to grow from 18.3 per cent to 35 per cent of GDP by 2030.

According to Chris Milliken, a partner in Baker McKenzie Vietnam, Việt Nam is at a promising turning point. It can learn from developed capital markets like the US, the UK, Hong Kong (China), Japan, and South Korea.

Although these markets have different systems, they share common goals of protecting investors and ensuring liquidity.

Milliken said Việt Nam should adopt global best practices in building its capital market rules. For instance, introducing a takeover code or easing regulations on share offerings and private placements could bring more clarity.

“What investors value most is consistency and clear rules. If Việt Nam aligns with international standards, it will lower the entry barrier for investors and quickly close the gap between them and local companies,” he added.

Indeed, the problem is structural. Though notable players like MoMo and Base.vn are gaining traction, the Vietnamese capital markets still present barriers. Strict listing regulations, especially for technology companies that may not yet be profitable, are a key obstacle.

Chairperson Vy pointed out that while manufacturing firms have physical assets and predictable profits, tech startups would operate on a different timeline.

“Look at Amazon – it took over a decade to become profitable,” she said.

“We need pilot schemes that allow pioneering tech companies to access the IPO market, even if they are not yet profitable but show strong growth and robust balance sheets.”

The consequences of inaction are visible.

As Vy noted, many foreign funds still lack a deep understanding of Việt Nam and remain cautious. If they cannot envision a clear exit within 5–10 years, they may simply redirect their capital elsewhere.

According to Nguyễn of Masan Group, there are reasons for optimism nonetheless. Việt Nam boasts a young, educated, and increasingly experienced workforce. He reflected on the transformation within Masan, where the once predominantly foreign-led leadership has been replaced by local talent.

“When I joined, 80 per cent of our group-level staff came from overseas. Now, it’s mostly young, talented Vietnamese professionals,” he said. “That’s a huge shift – and it gives me hope.”

Experts also believe Việt Nam can become a regional hub for private equity and venture capital by strengthening legal infrastructure and fostering a culture of transparency. Doing so would not only benefit current companies but create an upward spiral – where early-stage investors exit successfully and reinvest their capital into the next generation of start-ups.

“Investment isn’t just about money,” Vy said.

“It’s about mentorship, partnership, and long-term commitment. But at the end of the day, every fund needs to exit. If we can build a clear path for that, Việt Nam will become one of the most attractive markets in the region.” BIZHUB/VNS